Competitive analysis refers to the process of identifying your competitors and analyzing their strategies.

The goal is to gather as much intelligence as possible so that you can find out your competitor’s strengths and weaknesses in order to develop an effective go-to-market strategy to gain a competitive advantage.

SCIP (Strategic and Competitive Intelligence Professionals) Executive Director Cam Mackey defines the process as:

“A discipline that enables organizations to reduce strategic risk and increase revenue opportunities.”

Needless to say, competitive intelligence research is an invaluable process for any product marketing team. When conducted properly, it can greatly enhance your workflow and unearth vital competitive insights. These can help you:

- Spot gaps in the market

- Stay ahead of the competition

- Improve your products and services with comprehensive market research

- Meet demand and price accordingly

- Make more informed decision-making

- Support your sales team

- Improve resources such as battlecards.

It’s important to pay particular attention to your competitor’s announcements and keep up-to-date with announcements relating to a product, partnership, merger, or acquisition.

Furthermore, customer reviews are also a great source of intel when you’re trying to learn more about a rival product. They’re often available to the public and serve as a visualization of what your target audience is looking for in a product.

Here are the key questions you want to be able to answer when you’ve conducted market intelligence and fulfilled the data collection process.

- What is your competitor's strategy, and more importantly, how can you apply your findings to enhance strategic planning, and make smarter business decisions that’ll appeal to your target audience?

- What have they already done to effect that strategy that’s visible in product announcements, social media channels, webinars, press releases, marketing messages, acquisitions, statements, etc.?

- Where might they head next if they were continuing that strategy, and how might I get ahead of it?

- Which actionable insights can I transfer to the internal marketing team to improve business strategy?

Executive teams, and communications teams, require market intelligence to support the delivery of high-level strategic decision-making.

To help you answer these three questions, we're about to take you through:

- Why you should use competitive intelligence

- How to conduct competitive intelligence

- How to compare yourself to the competition

What is competitive intelligence?

Competitive intelligence is the practice of gathering and analyzing information relating to an organization’s competitors and using these insights to create a competitive advantage. This tactic helps businesses to understand their competitive landscape and the opportunities and threats that might be present.

What is the difference between marketing intelligence and competitive intelligence?

Marketing intelligence focuses on understanding customers and their actions. This makes marketing intelligence a client-focused activity that may involve understanding your customers and creating user personas.

Competitive intelligence on the other hand is focused on what your competitors within the market are doing. This involves collecting and analyzing data to find key insights into a competitor's decision-making and find opportunities and risks in the business environment.

What is competitive pricing intelligence?

Competitive pricing intelligence is a strategy used by organizations to track the price and performance of competing products on the market to determine how to make informed pricing decisions.

What are the common types of competitive intelligence?

Competitive intelligence isn’t all equal - there are two main types: tactical and strategic. Tactical competitive intelligence deals with more short-term issues such as increasing profits, whereas strategic activities help with long-term issues such as key opportunities and threats.

Which teams are responsible for competitive intelligence?

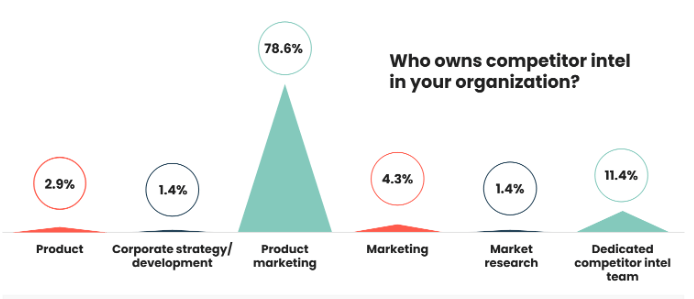

In the our Competitive Intelligence Trends Report, we explored who is responsible for the CI function to decipher which department owns the process and understand who is responsible in most cases.

Most product marketers surveyed (78.6%) indicated that they are responsible for competitive intelligence at their company.

The undoubted value of a dedicated CI team is being recognized, with 11.4% of respondents saying they have a specialist team who owns the process.

Adam Houghton, VP of Success at Klue, gave an insight into how the company’s client success team sync with PMMs across the board, and some of their common findings:

“Our Client Success team works closely with thousands of product marketers across multiple industries and company sizes.

"There’s a common thread we tend to see - understanding how they differ from competitors and where they fit in their market landscape is critical to success - not only for positioning and messaging to empower revenue teams to win, but to help drive product direction and strategy across the organization.”

Why should you use competitive intelligence?

Competitive intelligence enables you to learn from your competitor’s mistakes and strive to improve in areas where they may be better than you. Conducted properly competitive analysis will help you:

- Develop new products and features,

- Identify gaps in the market,

- Uncover trends, and

- Market and sell your product more effectively.

Competitive analysis helps you develop a deeper understanding of market dynamics so you can find the best way to reach your target customers. The information you gather will also help you develop and/or adjust your Go-to-Market strategy so it’s as effective as it can possibly be.

The importance of competitive intelligence in product development

A CI manager at Consensus Point and Cipher shared some insights into the importance of competitive analysis in product development.

My experience as a CI manager taught me the importance of conducting a wide market analysis to assess each player’s strategic positioning and in doing so, I uncovered a major competitor not mentioned in the report.

Upon deeper investigation, I understood that the competitor had begun product development two years earlier and was soon to release the product. Due to the competitor’s strong product, position, and status - this was a true game changer.

Once management was informed, the company decided to switch product focus and in hindsight saved millions by discovering CI insights. I often wonder how things would have been different without the use of CI.

Competitive intelligence challenges

There are a variety of challenges that can block competitive intelligence in your organization. This can stop you from reaping the rewards of CI.

Here are some challenges that PMMs face:

“At my company, there aren’t enough resources. I’m the only PMM.”

“There are a few areas I’m struggling with. I find it difficult to complete an apples to apples comparison, while it’s also tough to find pricing, hard to distinguish what a company does from their marketing hype.”

“We struggle with focus and prioritization. Most of the players in our space are not competition. Our offerings are not comparable and our target customers are not the same. We mistake everyone in the industry as potential competition."

“We have no budget and insufficient time to do it all manually. There are so many internal requirements for different information.”

“In the AdTech industry, your competitors can be your frenemies. So it is sometimes difficult to pick out your exact competitors.”

“There are too many methods and tools you need to apply to gather the same information.”

To help you overcome these problems and many more, check out our competitive intelligence course.

What are the goals of competitive intelligence?

There’s nothing worse than failing to learn from other people’s mistakes, and as we mentioned before, thorough competitive intelligence will show you exactly what your competitors have done wrong, paving the way for you to benefit from their shortcomings.

While the benefits and goals of competitive intelligence will vary from brand to brand, here are some of the core reasons to embrace the process and delve into the activities of your competition.

Spotting gaps in the market

There’s no doubting consumers will always be attracted to something new, that isn’t available in other areas of the market - it’s part of consumerism, and this will never change.

Making an existing product and pitting your wits against another company, and fighting for customers’ attention is extremely difficult. However, conducting competitive intelligence not only reveals what’s already available but also how you can fill a gap in the market with a brand-new product nobody else is offering.

Sportswear manufacturers Admiral executed this to perfection in the 1970s. Following the success of the England soccer team at the 1966 World Cup, owner Bert Patrick scoured the market and identified a gap in the market for replica team shirts. The company would go on to produce shirts for the likes of Manchester United, Arsenal, Tottenham Hotspur, and the England national team, with the likes of Adidas and Umbro, soon jumping on the bandwagon.

In using competitive analysis, Admiral spawned an industry worth billions to the sports industry, annually; the perfect testament to the benefits of keeping an eye on the ball.

No pun intended, honest.

Improve products and services

A pessimistic may say, ‘there’s no such thing as perfection’, but product marketers adopting a more optimistic stance would argue competitive intelligence can serve as the ideal way to aspire to achieve more or less the same thing.

Although mistakes are somewhat inevitable when making a product, or putting a new service together, (let’s face facts, we are human, after all), the shortcomings of other companies can’t be acted upon if you don’t know about it, which is all the more reason to scope out your competition, spot their flaws, and pounce the minute you get the chance.

Meeting demand and pricing accordingly

Competitive analysis also allows you to use the services being provided by your competitors as an indication of how market trends are emerging.

For example, research into product sales can provide insight into what customers in the field want, and don’t want, at any given time. This can be used during your product development phase to ensure you’re not promoting products unlikely to prick the interest of your target market.

Similarly, price is always a key driver behind whether a prospect converts into a customer, or whether they decide against making a purchase. Researching market trends will give a clear indication of how much money someone is willing to spend on a product; introduce a price that’s too low, and not only could you lose out financially, but you could also risk devaluing your product. Similarly, if you price too high, this can drive away customers, and thrust them into the grateful arms of other companies.

Use your competitors as guinea pigs, and analyze their strategy to inform your decisions, never make an impulsive decision.

Ultimately, there’s no doubt competitive intelligence can benefit your company. We'd go as far as saying it’d be pretty ignorant to think no lessons can be learned from those you’re competing with.

But before you can reap the benefits, you need to consolidate your understanding of exactly who your competitors are.

Crayon, a market, and competitive intelligence company, share the benefits of competitive intelligence with each team at your organization.

Benefits for your executives

"Your executives have a lot on their plates, but they need competitive intelligence insights to effectively steer the organization. While they might not be the ones acting on the insights, they want to have a view of the competitive landscape so they know what their teams are focused on. When you deliver insights to an executive, follow these tips for making sure they’re getting the most out of the data."

Benefits for your marketing team

"The information you gathered about your competitors’ marketing efforts, whether that be content marketing, events, social media, messaging, or A/B tests, can be used to improve and implement new marketing initiatives.

"In collaboration with the product team, your product marketers can craft stronger messaging to assist with upcoming product launches, website copy, and collateral for your whole organization."

Benefits and objectives for your sales team

"The information you gained about your competitors’ pricing, sales teams, and products can be used to improve your sales collateral, demo scripts, and sales processes. If you turn the information you gathered into sales battle cards or competitor profiles, your sales team will be well equipped with the information needed to turn competitor intelligence into revenue won.

"The data that you arm your sales team with can give them the competitive edge they need to better handle competitive objections throughout the sales process and win more competitive deals."

Benefits and objectives for your product team

"Gathering information about your competitors’ products from their websites, customer reviews, and online forums is a great way to improve your own products. Knowing the specs of your competitors’ products, how they work, and what people like (or dislike) about the solutions can help your product team iterate to make your product even better.

"There are many tools that you can use to assist with gathering intel and analyzing your competitive landscape. There is a lot of valuable data on the internet about each of your competitors, and with the right resources, you can seamlessly integrate competitive intelligence into your existing business strategy.

"If you follow these steps, you can pull out key pieces of intel, communicate it to your team, and derive value from the data you gathered during your competitive intelligence process.

How often should competitive intelligence be conducted?

So, now you know what competitive intelligence is, and how to conduct the research, you may be wondering when you should be completing the exercise.

Competitive intelligence is a continual job, and honestly, there’s no definitive answer to how often it should be carried out; the frequency will vary depending on how many companies you’re scouting.

Competitor research may be conducted weekly, bi-weekly, or monthly, depending on individual circumstances. However, what we can say is leaving it longer than once a month isn’t advisable. After all, the market and the behaviors of your competitors are always changing, and you could well be left behind.

It’s also important to note your stage in the cycle should also influence when you conduct your research into the competition. For instance, if you’re launching a new product, or making improvements to an existing service, you need to make sure you’re completing competitive intelligence.

The competitive intelligence process: how to conduct CI

First of all, you need to divide your competition into two groups: direct and indirect.

Direct and indirect competitors

A direct competitor is a business with a product or service similar to yours, which operates in the same geographic location.

An indirect competitor provides products that aren’t quite the same but could meet the same customer need or solve the same problem as your product.

If you’re comparing your brand, it’s important to focus mainly on your direct competitors. However, this doesn’t mean you should completely drop your guard around indirect competitors, they could quite easily become direct competitors in a very short space of time.

Get to know your competitor’s company

Use your competitor’s founding date, fundraising rounds, and employee count as a benchmark against your own growth. If your company’s been around for two years, where were your competitors at the same age? How fast was their growth? How much revenue did they generate?

You can find this information on websites like LinkedIn, AngelList, Crunchbase, and Owler. You can also use this data to set goals and projections for the year.

It’s not easy to find out information on market share, but it’s something that’s worth looking into. Big companies spend millions investigating competitors, we know that’s not a viable number for the majority of SaaS companies or start-ups, but there is a way you can get a ballpark figure without spending a ridiculous amount.

Conduct a survey with a decent sample size of respondents and ask them which solutions or tools they’re currently using, if the same products or companies keep popping up you've got a solid estimation of their market share.

Get to know competitors’ products

You'll need to analyze your competitor's complete product line along with the quality of the product or services, looking at the competing product’s strengths and weaknesses.

How do customers perceive your competitor’s product design, quality, and price

Make a list of your competitor’s core product features and compare them to your own, looking at which features your competitors offer that are unique to their product. How do your same features measure up?

Look at pricing and whether or not they’re offering discounts to users. Ask yourself the following questions:

- How are the products distributed?

- Which methods are used to differentiate products from competitors?

- Does the company offer a budget or premium product?

- How do customers perceive the product’s design and quality?

- What are their customers’ needs?

- Is their online pricing different from their in-store pricing?

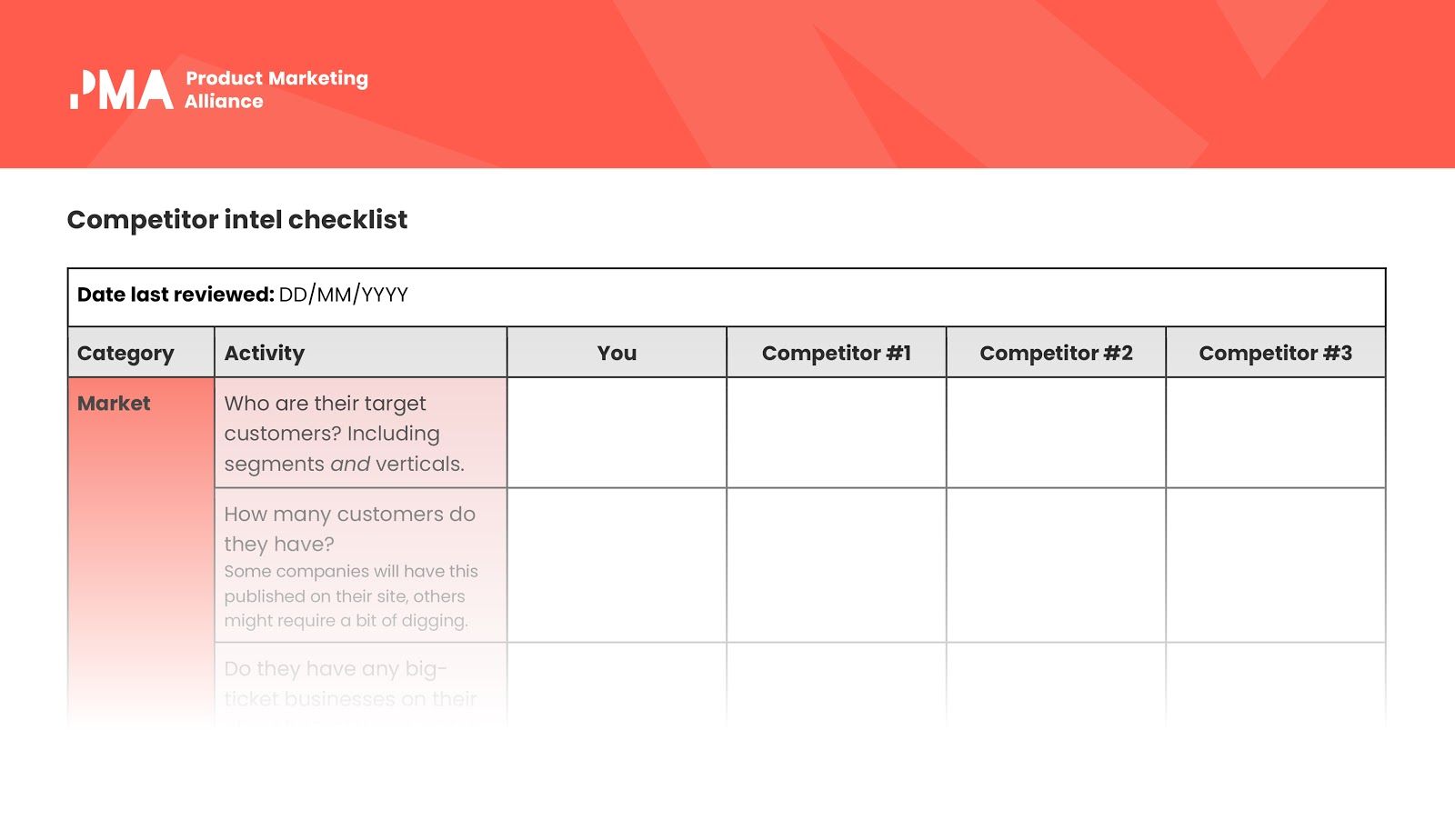

Check out our members area to unlock the competitive intel checklist below.

Check out your competitor's marketing methods

Scoping out your competitor’s website is the easiest way to gauge their marketing methods. Do they publish regular blog content? Do they make Vlogs? Podcasts? What advertising campaigns are they using? Is there an FAQ section? Look at the company’s about us page, What story are your competitors telling customers? How do they position their product?

How do they describe its value proposition and benefits? What’s their tagline?

As well as products and marketing, it’s important to research other areas, including:

- Sales tactics

- Content strategy

- Customer success approach

- Social media presence

You’ll want to look at the kind of topics they cover on the blog and how their customers engage with it. Are they commenting? Sharing? Liking the content?

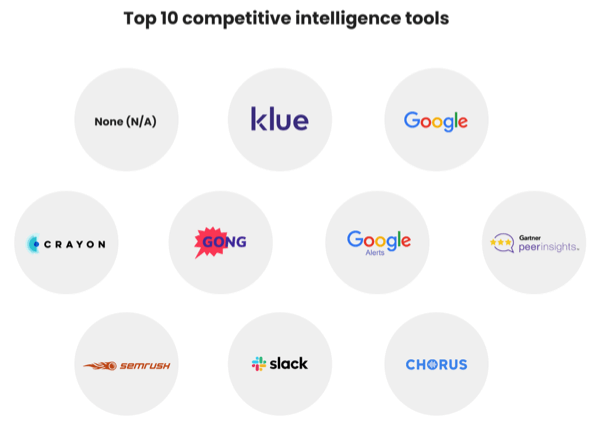

And, to help speed up your shortlisting process, we put together a tried and tested list of competitor intel tools, personally recommended by product marketers.

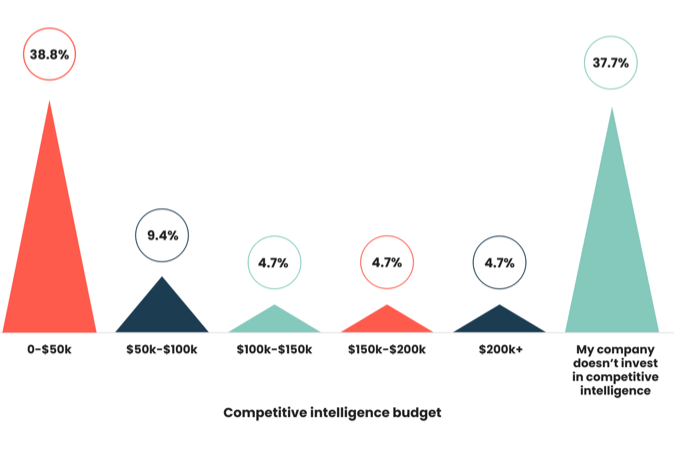

Is enough PMM budget spent on competitive intelligence tools?

Whether it’s an awesome product launch, compelling messaging, or essential sales enablement assets, investment plays an essential role in the success of every facet of product marketing.

This prompts the million-dollar question: is enough money being spent on competitive intelligence?

In our Competitive Intelligence Trends Report, we asked our crop of PMM experts how much budget is allocated to competitive intelligence at their companies, and it was encouraging to see 62.3% of respondents indicated their orgs are setting money aside to support the function.

Chris Owen, Director of Product Management at Saviynt, explained how the company used existing data to incentivize company executives to invest in a competitive intelligence program:

“The first thing we did at Saviynt was targeted the exec team with the concept of a CI program, asking how we can stretch our competitive landscape from 1 to 40.

“By starting with the data we have in Salesforce, and broadening that to the other software areas in which we exist, we were able to predict how much we could increase our win rate by targeting certain competitors. That really incentivized them to move forward with a CI solution.”

What are the best competitive intelligence tools?

As highlighted in the Product Marketing Tools of Choice, there are plenty of competitive intelligence tools available.

Here are the top 9 competitive intelligence tools:

- Klue

- Crayon

- Gong

- Google alerts

- Gartner peer insights

- SEMRush

- Slack

- Chorus

How do you compare your competitors?

It’s really important to establish an internal baseline before you compare your competition. Look at your sales, business, and marketing methods through the same lens you’d view your competitors. Record the information and use this to compare across the board, the information you gain can also be really helpful when the time comes to perform a SWOT analysis.

What is SWOT analysis?

If you're looking for a way to get an accurate overview of your product’s strengths, weaknesses, opportunities, and potential threats stick with us and we’ll explain how to conduct one.

And how you can use it to blow your competition out of the market.

SWOT is an acronym for Strengths, Weaknesses, Opportunities and Threats.

Strengths: what sets you apart from the competition? Do you offer a feature unique to your product? Are you an innovator? Do you have an established, engaging social media presence?

Weaknesses: what is it that’s stopping you from having a competitive edge? Is it a lack of capital? Is your marketing strategy letting you down?

Opportunities: these are prospects or openings you could take advantage of to get ahead of the competition. They could be new developments in the market you serve, a new trend, or perhaps a popular feature you're sure you could improve on.

Threats: include anything that could negatively affect the business, internal or external. For example, evolving technology is always a threat! Anything that makes you especially vulnerable in the market is a threat.

How to conduct a SWOT analysis

You don’t have to be psychic to conduct a successful SWOT analysis (although that would definitely give you a competitive advantage) it’s not about being exact in your predictions, it’s about planning for any and all eventualities.

Specify an objective

It sounds kind of obvious but it’s worth reiterating, establish exactly what data you're trying to gather and assess, this way you’ll know precisely what to look for in the research stage.

You might want to run a SWOT analysis to decide if you should introduce a new feature or launch a completely new product, add a new department or outsource a specific process. It’s flexible enough to assess all kinds of different areas across the organization.

Assemble an elite team

You’ll want to assemble a team whose knowledge and experience closely match your objectives. Your team can include customers, stakeholders, executives, anyone you deem a match basically, the more feedback you can gather the better.

Research, research, research

It’s time for brutal honesty. You need to carry out some truly unbiased research to find out where you stand in the market.

Be honest about your weaknesses, because, well, not to get all Mr. Miyagi on you, but your weaknesses could very well lead you to your biggest strength. Be just as honest about your strengths too, without this research you’ll never be able to compete or maintain your advantage.

Make a list

Using a grid formation, or better still this free template! Use each square to condense your results (strengths, weaknesses, opportunities, and threats) into short, snappy sentences. Always use the points that crop up most frequently in your research, these are the ones that’ll pack the most punch.

This template is a great way to visualize your success and find potential connections between each square, could your strengths be used to eliminate a weakness? Could eliminating a weakness open the door to a new opportunity?

Take action

Making plans and mapping out strategies is all well and good if you actually follow through.

Now you have the results, what are you going to do about it? You're going to prioritize your list into an actionable plan you can tackle straight away.

Think about what you and the team can realistically address right now, then think about what you can tackle and how long-term.

Make sure your action list is measurable. No vague statements like ‘increase productivity’’ thank you very much! We want to know how you’ll increase productivity, actions like ‘investing in a new platform, to make accessing client information easier’ or ‘investing in a PMA Team Membership plan, so everyone is aligned and has access to the same templates and vast library of content 😉’. Don’t forget to set goals and KPIs so you can measure the success of your objectives too.

Depending on the size of your team you could delegate an action to the specific person whose experience aligns best with the objective (someone who has buy-in preferably). Set an allotted time to sit down with this person and set benchmarks and measurable goals.

Finally, create a timeline to begin the action and complete it. Breaking up the timeline into manageable chunks ensures everyone can see the progress unfold and your best-laid plans won't fall by the wayside.

If you’d like to take a deeper dive into SWOT analysis, we have a number of resources you can access in our members' area.

6 steps for a successful competitive intelligence process

Crayon shares their top six steps to a successful competitive intelligence process.

1. Identify your competitors

"The first step in the competitive intelligence process is to identify your competitors. Have a robust competitive landscape. Start with your top five direct competitors. In addition to your direct competitors, you should identify your indirect competitors, your aspirational competitors, and your perceived competitors.

"Your indirect competitors are key players within your industry but likely don’t compete with you for customers. Your aspirational competitors are those leading companies within your industry that you don’t necessarily compete with, but you can pull inspiration from to benefit your own business.

"Finally, your perceived competitors are those companies that may come up during the sales discovery process, but that you don’t actually compete with for business.

"If you want to segment your competitive landscape even more, you can break it down by sales vertical or industry focus, and solution type. Identifying your competitors is key to beginning your competitive analysis and diving deeper into your market to understand your competitive landscape."

2. Track competitors’ digital footprints

"Once you’ve identified your competitors, and who you want to start analyzing, you should choose major focus areas for the data you need to collect. Consider all of the data accessible online about each of your competitors as well as internal knowledge from your front-line teams. If you narrow down the types of intel you care most about, data points that align with current initiatives, it will be easier to digest the data.

"If you’re unsure where to start, try exploring some of the most engaging competitive intelligence types."

3. Gather your intel

"The act of gathering the intel can be the most time-consuming step of the competitive intelligence process. In fact, The State of Competitive Intelligence reported that 33% of time dedicated to CI/MI goes toward the research phase. This is where you have to take the time to explore your competitors’ online presence and gather information about their products, websites, teams, announcements, social media engagements, content, and everything in between.

"You want to gather the most intel about each of your competitors so that you can dig in and analyze the data to pull out the valuable insights."

4. Create a competitive analysis

"Analyzing the intel is where your analyst or competitive intelligence manager breaks down the data, pulls out the key trends and essential pieces of information, and organizes the findings so that they can be easily communicated throughout your organization.

"Creating a competitor analysis can be done a couple of different ways. One way is to do a benchmark or baseline analysis, which will allow you to compile your data and create a competitor profile.

"Competitor profiles or battle cards are highly useful to ensure that your findings on each competitor are being kept within one centralized document. An equally important approach to competitor analysis is to analyze competitive intelligence on an ongoing basis, in real time.

"It’s beneficial to create profiles on your competitors, but it’s even more valuable to continue to track your competitors. The best way to keep a pulse on your competitors is by setting up alerts on everything from new news mentions to product changes to customer reviews. That way, you can stay on top of your competitors’ moves and continue to arm your team with up-to-date analysis."

5. Communicate intel

"The worst thing to happen when you’ve gathered competitive intelligence is if no one consumes your findings. You want to ensure that the key stakeholders see your findings and that the data is being leveraged to improve your own strategies. The State of Competitive Intelligence report found that 66% of companies share their competitive intel via email, 54% use meetings, and 25% of companies use an internal chat.

"A useful tool that many people take advantage of for intel communication is Slack (or other internal chat), where they can easily communicate competitive intel to their whole company via instant message. Another great place to store complete competitor profiles if you don’t have a CI platform is on a collaborative website such as a company wiki or intranet. That way, you can alert your coworkers when new intel is added, and you can ensure that the information is in an easy-to-locate place."

6. Turn data into results

"So, now you’ve identified your competitors, gathered intel, analyzed the data, and effectively communicated your findings to the relevant stakeholders. The final step is to make your data actionable - use your findings to benefit your overall business strategy. Here are a few ways you can make the data actionable for each of your key stakeholders."

Deliverables to watch out for

Deliverables are an effective tool for getting the right information to the right people to drive action. Here are some examples of deliverables to consider implementing in your organization.

1. Alerts or Watchlists

Create alerts or watchlists to get notified about changes in your industry or updates on your competitors' actions. These alerts can give you quick updates on your competition regularly to keep you in the loop.

2. Dashboards

Keeping data on a dashboard keeps it visible and allows you to check data at a glance. You can easily find all the data-driven insights you need to compare your organization to competitors in one place.

3. Newsletters

Sending short weekly newsletters internally in your organization can help to give insights to the right team members. These newsletters could share all the new information on a particular topic so it can be read quickly. This can help everyone stay on the same page.

4. Reports

If you need to go more in-depth into a particular topic or area, a report might be the best way to share this information internally. They will analyze your insights in an impactful way and share these findings within your organization.

5. Competitor Profiles

Competitor profiles can provide key information about your competition at a glance. These should be very short and specific. Think of these profiles as one-page fact sheets on each of your main competitors.

Remember to update these regularly to keep the information up to date.

How to monitor competitive activity

Emily Dumas, Content Lead for Product GTM at ZoomInfo, shares her top insights into monitoring competitive activity.

Set yourself up for success

"Before you begin monitoring your competitors, you need to set yourself up for success.

"Competitive intelligence (CI) can’t be conducted in a vacuum—if you’re conducting CI on your own, with no clear goal in mind, your CI program won’t be impactful for your organization.

"Here are four actionable items to complete before you get started monitoring competitive activity:"

Identify your competitors

"Every company has multiple competitors, even startups. The first step in monitoring competitive activity is identifying who you’re competing against. Depending on the size of your company, you might have many competitors.

"At first, you don’t want to go after your entire competitive landscape, so break down your market, and tier your competitors based on who you compete with for the most revenue. Start with tier one, two, and so on."

Identify your stakeholders

"Externally, you’re identifying your key competitors. Internally, you need to identify your key stakeholders—who within your organization is integral to your CI program?

"While everyone within your organization can benefit from Competitive Intelligence, you will have a group of key stakeholders that you’ll work closely with, who will be the main consumers of your intel.

"Some examples of key stakeholders might be:

- Product Marketing Managers

- Sales Enablement Managers

- Product Managers

- Sales leadership

- Marketing leadership

- Executives"

Set a cadence for monitoring

"Conducting competitive intelligence research doesn’t have to be time-consuming. If you can set aside a certain amount of time every week or month to focus on CI, you’ll soon build a habit of incorporating competitive intelligence into your day-to-day.

"When setting a cadence for monitoring competitive activity, you should take a few variables into consideration:

- How much time can you realistically allocate to your CI initiative?

- How many people are dedicated to CI on your team?

- How often are changes happening within your market?

"There is no right or wrong answer to how often you should be conducting competitive intelligence research. It all depends on your unique market and your business needs. Whether you’re going to spend 10 minutes per day or five hours per week, just make sure you set a cadence and stick to it."

Set goals and KPIs

"As a product marketer, you know that it doesn’t make sense to kick off a new project without setting goals and KPIs. When it comes to CI, you should set both short-term and long-term goals, as well as a combination of both quantitative and qualitative KPIs.

"Some examples of KPIs:

- Revenue - how has your revenue changed? (Revenue is the ultimate KPI!)

- Win rate - how has your win rate improved?

- Strategy shifts - How has your strategy been impacted by CI?

- Employee engagement - Is there a high adoption rate of your CI tools? Are your teams benefiting from CI?"

Making competitive intelligence actionable for product marketing teams

Q: How do you make competitive intelligence useable for your team? I'm curious about tools or processes that have enabled your teams to effectively understand both high-level and detailed competitive intelligence.

“Slide deck presented in a lunch and learn format, and Ask Me Anything; mix of high level and granular. People can come to you individually for deeper dives.”

Yuting Chu, Digital Product Manager at CrowdDoing

“Useful deliverables: External - one slide for customers showing where you are better (tick marks vs crosses). Internal - two-page battle card with strengths, weaknesses, how to attack, etc.”

Anatolii Lakimets, Senior Product Marketing Manager at Bold

“Sales will be focusing on individual deals and their territory - product marketing can add value by looking more broadly at trends and collating to give a larger picture. We tackle market intelligence a few ways at my company:

- Maintain battle cards for tier 1 competitors, quick SWOT analysis for tier 2 and emerging competitors, and quick readouts of competitor news (investments and acquisitions, product updates, etc) analyze closed opportunities each month for win/loss, and do a quick recap on Slack to build interest in our market position.

- Build an overview of key competitor analysis for new hires with a picture of where we win/they win.

- Run workshops with sales to analyze recent deals, to get them to talk to each other and share insights. E.g. how to spot a competitor, what traps they leave for us when to walk away.

- As we build up a better picture of our competitors we create assets such as one-pagers to show reasons to choose us vs them. It’s not a feature comparison or checklist but we highlight our pricing strategy and how that helps customers to grow with us, for example.”

Louise Dunne, Product Marketing Manager at Linnworks

“Table with comparison by features and pricing. Newbies onboarding and testing. Bi-weekly meeting about the news and competitors. Chat in the Slack or Telegram for hot news, questions, and updates.”

Alexandra Kulachikova, Product Owner (ML-based SaaS for B2B) at Semrush

“In my experience, sellers want very straightforward competitive materials. Our battlecards are built in Crayon and integrated to live in Highspot with the rest of our collateral. They consist of:

- Quick dismisses (< 10-word responses when a competitor is mentioned)

- Long-form content for emails

- Shareable collateral (G2 grids, case studies, etc)

- A feature comparison

- Negative customer reviews (from G2 and TrustRadius)

“Our executive team gets a monthly newsletter summarizing competitive product changes, acquisitions, funding, pricing updates, employee headcount changes, and competitor mentions (tracked via Chorus).

“Product managers get semi-annual reports based on the products that they own. In the reports, we include information from analysts, NPS, win/loss reviews, and survey responses that help them better understand what to prioritize for their roadmaps.”

Andrew McCotter-Bicknell, Product Marketing Manager at ZoomInfo

Access this complete toolkit - and more - right here. 👇

What's inside this guide?

Whether you've got a big competitive intelligence session on the horizon or just want to brush up your knowledge, learn from the best, and see how others keep an eye on their competition, here's a selection of presentations, templates, and guides assembled by competitive intelligence professionals to help you keep tabs on your rivals during your next CI project.

Part 1: presentations

Part 2: templates

Part 3: competitive intelligence guides

There's plenty more where this came from. 👆

Unlock it all in here. 👇

Head-to-head: The Competitive Intelligence Playbook has been designed to include all the most important insights and steps needed to build and refine your competitive intelligence strategy, and ultimately win your market...

Follow us on LinkedIn

Follow us on LinkedIn