If you want to do a better job of understanding why you’re losing deals, the win/loss lifecycle can help. The lifecycle is a useful framework for considering the options, and picking a program that will meet your goals.

Introducing the win/loss lifecycle

A new or upgraded win/loss program (good definition here) is often initiated with expectations of broad change, because it’s been triggered by a painful issue like early stage losses. This initial period of broad change is followed by a longer period of narrow change, when the program is used to track the impact of the initial changes and identify other areas of improvement.

Win/loss programs must be flexible, to support these alternating periods of broad change and narrow change (as shown in the wave graphed below).

Where are you positioned on the win/loss lifecycle?

Broad Change: You’re in a phase that requires broad change if you'll use the loss insights to fix issues that are verifiably affecting the company’s revenue; that require substantial cross-functional effort; or that have become high profile by virtue of previously unsuccessful attempts to solve them.

For example, early stage losses is a topic I speak with people about a lot. Fixing this can require changes to product, positioning, pricing, packaging, or sales process. Initiating substantial, cross-functional change like this requires insights that are incontestable - totally trusted; no doubts; no arguments; just action.

Narrow Change: You’re in a phase of narrow change if the team sponsoring the research will use the loss insights to make incremental improvements. Updating battlecards and positioning based on the latest competitive intelligence, for example. Or improving the sales motion based on buyer feedback about the sales experience.

The optimal win/loss program combines methods for both broad and narrow change

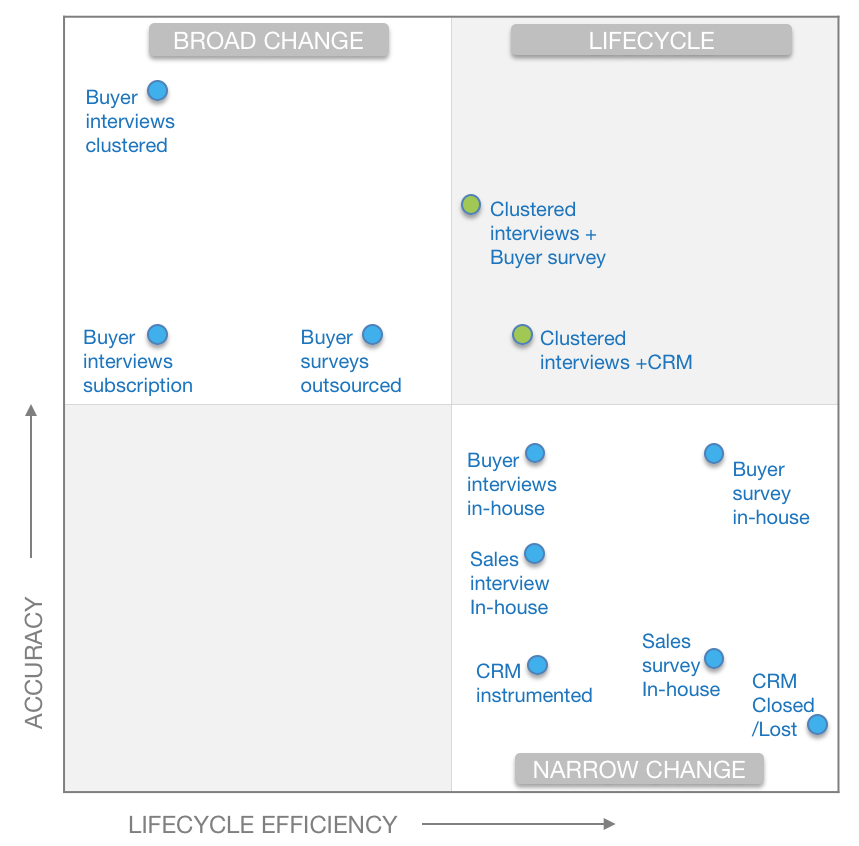

You can optimize both the accuracy and efficiency of your win/loss program by combining multiple methods for data collection and analysis. Use a lower fidelity, lower cost method as the foundation for your program, and supplement it with a high fidelity, higher cost method during periods of broad change.

As the foundation for your Win/Loss program, choose a data collection method for narrow change. These techniques maximize efficiency first, then fidelity. In the cell labelled “Narrow Change,” these three methods do the best job of this:

- Buyer survey run in-house

- Sales survey run in-house

- CRM closed/lost reasons

Then, when troubling data is flagged by the narrow change baseline—or at least once per year—supplement with a broad change method that provides the highest fidelity insights. For example, your buyer survey may reveal increasing losses to an emerging competitor, or you may see a downward trend in buyer satisfaction with the sales experience.

During a phase of broad change, use data collection methods that first maximize accuracy, then efficiency such as:

- Outsourced buyer interviews with a clustered model

- Outsourced buyer surveys

Outsourced buyer interviews with a subscription model have a Goldilocks problem that impairs accuracy, making them inappropriate for a broad change win/loss program. Analysis and reports are based on either too few deals, just 5 or 10 in the past quarter. Or, they’re based on a larger group of 20-40 deals that are 3 or 4 quarters old.

We’ve found two broad/narrow combinations that optimize both accuracy and efficiency (they’re marked with green dots in the chart).

- Clustered buyer interviews and buyer surveys

- Clustered buyer interviews and CRM lost reasons

Take a mixed methods approach to win/loss analysis

While it’s true that buyer interviews can yield the highest fidelity, most accurate data, they’re also the most expensive approach to collecting win/loss data.

The optimal mix of accuracy and efficiency is achieved by win/loss programs that combine multiple methods of data collection and analysis.

For example, a win/loss program that utilizes buyer surveys as its foundation and supplements with clustered buyer interviews will be responsive to changing needs over the win/loss lifecycle (this combination is marked with a green dot in the matrix.) And at the same or lower cost than a baseline set of twenty buyer interviews.

Want to learn more?

Needing to measure your product marketing success is a huge part of the role. After all, how are you going to identify what works and what doesn’t without metrics and data to back it up?

Our Metrics Certified: Masters course will give you the knowledge and confidence you need to measure the impact of your work and continue driving, not just your product and department, but the entire company towards success.

By the end of this course, you’ll be able to:

🎆 Use formulas to correctly measure key metrics.

💪 Identify which metrics you should track for each deliverable.

👀 Understand how your work can positively influence these metrics.

🔦 Relate your KPIs to your OKRs and confidently report on the impact your function has on the business.

Ready to get started?

Follow us on LinkedIn

Follow us on LinkedIn