You might be wondering why I’m discussing pricing in a product marketing focused article? In my opinion, pricing is a product marketing domain because as a PMM you’re an expert in the buyer persona and part of that is value under which pricing falls.

Here I’ll explain how as a PMM you can get yourself a seat at the pricing table through the areas you can influence in your organization and a series of steps to success.

I'm going to write about a bit of an unusual subject - pricing, how product marketers can get a seat at the pricing table. I wanted to engage with pricing, you're probably wondering why am I talking about pricing in a product marketing article, but it is product marketing.

My simple definition of product marketing is really being an expert in the buyer persona, and in order to be an expert in buyer personas and in the buying cycle, you have to be able to express what value is. With that, you very quickly land at the pricing.

The agenda

- Pricing ownership

- What is pricing?

- Areas PMM can influence pricing

- Starting with pricing in your org

- Summary

- But first...

About me

My name is Axel Kirstetter, I have been with the Merrill Corporation for three years, the company provides software for the M&A lifecycle helping companies in their due diligence situations.

My title's VP of Product Marketing, Content Marketing, and Pricing, and I've been doing the wider subscription world for about 10-15 years now, and I'm really quite versed in everything subscriptions.

Pricing ownership

Who in your organization owns pricing? Is it the finance function, product function, sales, or marketing? It's not unusual, in terms of who delivers value that it tends to be the product management organization.

In this section, I want to cover really how product marketers can own more of the pricing discussion. Let's start by level setting.

What is pricing?

Pricing in context

It comes back to the four P's - price, product, promotion, and place.

They've been around for a long time and within that price is a sort of dedicated function of really the ability to express value. Within that, you also have to nowadays take into consideration the process systems element of things.

There are dedicated systems like configure price quote - CPQ, that help marketers really understand how to enable pricing. There are, in the consumer world, price optimization tools, which again allow you to work out given supply, given demand, what exactly is the price point that you need to be working at?

People wise, it is a bit of a unique skill set and people in pricing typically are Excel experts. One of the big debates right now in pricing as a matter of fact is what kind of skill set is most important? Do you need to have Python coding skills or R coding skills? So there's a dedicated skillset required within that.

Pricing in action

How do you turn that into some actionable information?

Positioning

It really starts to me with the positioning side of things. Simple question, are you premium? Are you low cost? By the way, there's nothing wrong with being low cost. Companies will often choose to say, "Oh, we're premium" - there is tonnes of money to be made in low cost, just ask Jeff Bezos.

Pricing policy & governance

Who is allowed to discount, how much, all the questions around that ?

Monetization type

Subscription, transaction, is it the perpetual is it, per user, is it per volume? All those discussions need to be had as well which heavily impacts how you can market your product.

Competition & competitive thoughts

Especially if you want to take out a competitor, you do need to worry about do I want to take market share for them or am I going to lose market share for them? Losing market share could be desirable if that means you increase your price - price times volume equals revenue - a desirable outcome to have had as well.

Cost structure

If you are in certain competitive markets, and you've got the wrong price point, the price point is too high, cost structure not aligned, you're gonna have to take out some of the underlying capabilities, then the question is, are you still competitive?

Sales promotion

Sales promotion, push efforts, do you discount, do you uplift? All of those things are possible. What I want to do here is just go over a couple of areas of how you can influence the overall discussion around what pricing is all about.

Areas PMM can influence

This is an overall area of the type of assets product marketers are likely to touch upon which influence according to different stages in the cycle.

Prospect, lead, close, awareness, consideration, decision, it's all substitute for essentially the same thing, sort of six stages.

This is coming from Sirius Decisions, they would define that but within that, you'll see a lot of familiarity over the areas that you can actually influence. Whether it's the website, a lot of websites, especially as it touches on consumers on smaller businesses tend to disclose what their price levels are at.

Somebody has to write what that is typically, websites on the marketing, therefore, they like to go to their product marketing colleagues, to work out what the right price point ought to be.

Sales playbooks, again, I've never done a sales playbook without specifically being asked to review, approve, and go into the details, and that also includes pricing. We're going through a new education cycle right now for our sales teams, and specifically, they want to know what is our price book?

I'm the owner of the price book for our company, and it's got tonnes of skews in it and so it's about translating all those 10s of thousands of skews into something meaningful that they can actually use. Contracts as well, I'll be spending more time on that later. This is just an overall area of how product marketers influence what really is pricing.

Pricing touch points

These are six touch points I'll be going over individually to help you identify areas that you can start influencing, having more of an influence on the overall pricing discussions.

Audience insight

This is something that's come up over the last two or three years as really one of the most exciting areas for product marketers to own. If you don't own it, at this point, I highly recommend you start getting involved in this. Audience insight is all about, at the end of the day, what's the willingness to pay?

There's no reason why product marketing, who owns the website channel, who owns the email channel, isn't able to identify through data technology, surveying, polling, etc. what people are willing to pay. It all comes down to the trade-off - preferences between features and functions, and you can run tonnes of surveys, there's plenty of tools out there.

It's all about customer experience management companies like Qualtrics, Survey Monkey, that have some of that built into what they do.

Path to success

I highly recommend creating your own research community that you can get into and ask some straightforward questions around. How do you value us? What's your brand perception? And as you explore that a little bit really go down into the details of are we pricing right?

You can do gamification exercises, and really find out what is the level of engagement around pricing that people are comfortable with? We actually did some of that for our own company where we tried to price a new feature, and we didn't exactly know how people will be responding to it, so first we created a community, we basically tapped into our database of existing users around LinkedIn campaigns and specifically went out and recruited people to participate in our panel.

At this point, we have something like 1500 people that on a bi-monthly basis we tap into and ask them questions. Here's what we did. We simply described to them what the product was that we tried to get feedback on and asked them, would you be willing to pay this much?

Different mechanisms, we're using a tool called Conjoint.ly, which has all that built into the system. It asks are you willing to pay 10/20/50/100, it doesn't do it in a linear fashion it just throws different numbers at you to see where some will be coming out to pay. Here the curve is pretty clear.

That peak is exactly where we ended up coming out because that's where the price point is optimised. So a very easy exercise on that.

Audience insight - highly relevant.

Buyer research

This is all about personas, that being said, I'm going to take a slightly different tack on personas. It's not so much the user persona, which product managers care about. It's not so much about the buyer personas, which typically product marketers care about. It's the value persona, as you go down the path of really trying to understand who you're selling to, it's also about how do they value what you do?

Tools & activation

Path to success

An exercise of getting there is really doing a lot of field research. I highly recommend you spend a lot of time doing win-loss analysis. It's easy to focus on the wins but focus on the losses. Don't even ask your sales teams, and just again, a bit of context, my company is a bit more B2B, high volume B2B, so it has some B2C type of touchpoints along the lines as well.

But we have a very rich CRM database, and everyone has access to it, and I can simply look at it, identify the losses, and just call people up, set up an appointment. It's really interesting what you find out, including also how do you perceive our value?

The database will tell you, "Yeah, lost because of price", then when you call them up they say, "Actually, no, you lost because I couldn't stand the salesperson". That's not something they're going to put down into the CRM.

What is the value persona?

A company called Price Intelligently is very big on this and they're trying to establish the distinction between not so much what is a buyer persona in terms of:

- Where do they drink?

- Where do they eat?

- What do they think? Etc.

But,

- What do they value?

This is just an example which they came up with:

It's called Table Stakes Tony and Advanced Arnie, it’s a collaboration type of tool. The valued features are Salesforce integration and Chrome extension for Tony. For Arnie, its analytics and API access.

Tony is willing to pay 10 bucks a month, the cost of acquiring is $22 (by the way $22 is extremely cheap if you can get that). Whereas Arnie is willing to pay 25 bucks a month, so 150% more than where Tony is at, however, the cost of acquisition is also 150% more.

Lifetime value 160 versus 325. So exactly the same buying persona, exactly the same type of user persona, but they value the features within that very, very differently. Depending on what you're trying to do from a market penetration acquisition strategy, it fundamentally changes the way we think about this.

Think about value persona and go to Price Intelligently.

Funnel management

It doesn't matter whether you have a marketing qualified lead process, the classical five-step waterfall, product qualified lead process, somewhere along the line, you'll be getting across a point of conversion.

Tools & activation

That conversion does include talking about price. On the website, obviously, it's a little easier, you sign up for the trial, usually sign a contract, at some point, you have to tell people this is what it's gonna cost you.

In the consumer world, they've really made it very, very difficult to figure out how much it's actually gonna cost you until the first bill comes up, and a lot of companies are beginning to copy that format.

Path to success

But someone has to sit in the background and work out what the pricing is. I suggest that is you, given the ownership of the website and of email communication. You can do AB testing, you can do entire purchasing journeys, and so the path of owning that is really working with your digital team.

Map out the buyer journey so you've got your persona framework, your buyer journeys, and then just replicate all that on the website - it's very easy to do. This is what typical funnels would look like.

Proposal and packaging management

This should be close to your chest, I hope so anyway. Someone has to do a proposal, a statement of work, package it up, how it's being presented, there is an art and a science to it.

Certainly, the art part of presenting it in a way that looks nice is something that marketers quite often do. If you don't currently own it, make sure you talk to the marcomms team, make sure that wordings right.

The one thing that always amuses me is salespeople, by nature of their profession, need to do a lot of talking and from that, you can imagine they can probably articulate very well what they do, end up coming back asking why I can't express myself particularly well can you write it for me?

Tools & activation

A very simple exercise is, just pretend that you need to do a standardized sales introductory letter and then roll that out into the rest of the proposal. Once you do that, make sure the value proposition on the website ties into the sales proposition that also ties into the statement of work.

Very quickly you own a bottom-of-the-funnel aspect of how pricing finds itself to the customer. That's quite an exciting way to get more involved in that. This is our pricing proposal or at least a micro version of it.

Path to success

What we did is turned it from a landscape orientation Word document into a PowerPoint framework. By changing it around we had an opportunity to redesign the entire proposal, standardize it globally as opposed to having 50 individualized Word versions out there, and it became a very powerful tool for us to just express a couple of key-value propositions that we wanted to get across.

The second page of this particular one has then the specific price points for whatever the client's scenario is like.

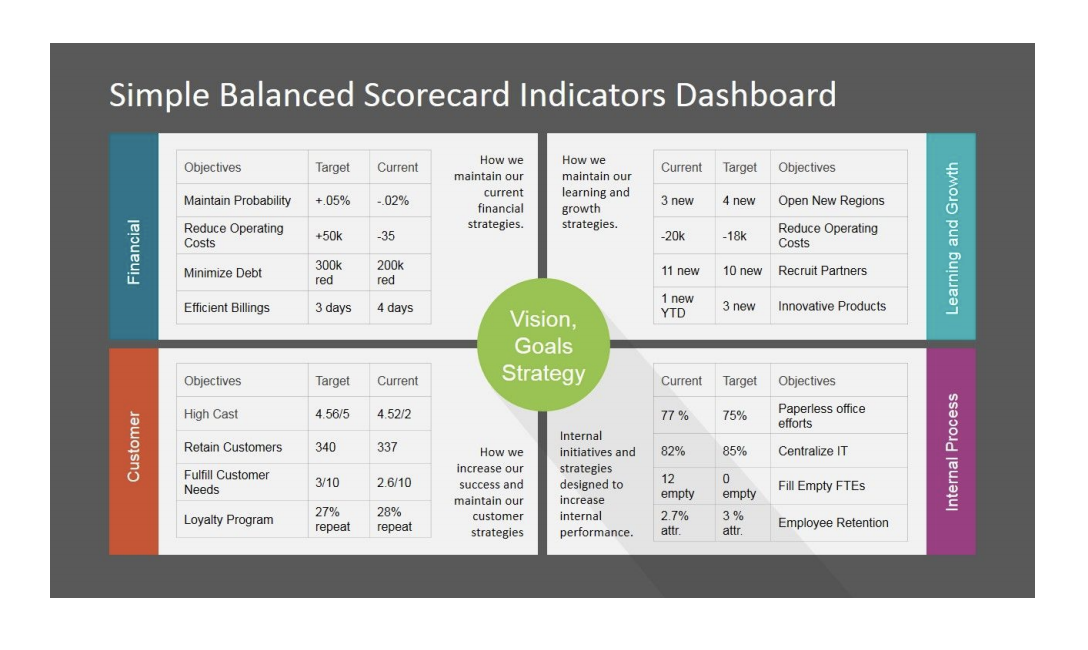

Performance reporting

I don't know if you do any quarterly business reviews or half annual business reviews, but to me, this is a critical way for you to communicate how your product line, your product, your segment, is performing.

Path to success

I always like to dedicate a good four hours of my monthly cycle to dig deep into the CRM to understand what is the average price point? I find it very difficult to talk about my segment performance, my product performance, without talking about how's the price doing?

Revenue, at the end of the day, is made up of quantity times price, so unless you express some kind of price component, there's something missing. Analyze the data in CRM, create those quarterly artfacts, make sure there's an audience that's willing to debate - it's good, it's not so good, or wherever it's at.

Trend lines are helpful to work out whether last month's price is up or down. Monthly thinking doesn't help, really annual, last year to this year, etc. This will be some samples of what a Business Report could look like.

It doesn't matter whether you use a scorecard type or an actual quarterly business review, just make sure there's something in there about price.

Influencer management

This is one of the ways that I've always tried to get feedback from the market at large as to how am I doing from a price perspective. I know what my clients are wanting to pay in terms of what's in my CRM, but I don't know, especially at the early cycles of a new product, where does the price that we want to put out fit into what the market is up to?

Tools & activation

At previous companies I would have worked closely with analysts, Gartner, Forrester, etc. and you could just ask them, I want to come in here, and they'll tell you, "No man's land, you need to be either here or here". Or they'll tell you, "Yeah, that's about right".

But you can get some concrete answers as to whether you're on the right path. It doesn't have to be just analysts, there are journalists and bloggers who really understand the specific markets, or conference organizers as well, who are deep in specific segments and industry areas.

Path to success

Find those people, find those influencers, and try to engage with them and understand how you're doing on your pricing level. Here's sort of the overall overview of how many different types of influences there are, depending on which area you probably need to spend a bit more time with one or the other.

Starting with pricing in your organization

How do you start with the pricing journey in your organization? This is again back to the influencer insights that you can achieve. We divided it up into three basic steps.

Conduct qualitative interviews to identify value

The first step is really understanding from a qualitative perspective, who your audience is all about.

Conduct win-loss interviews and pick the ones that were lost due to price

We conducted straightforward conversations with clients, especially on the win-loss analysis, as to why they did not choose us. From there we had a really strong value proposition understanding.

Listen for common value proposition changes

When you develop a value proposition, it's not always perceived or received in the same way and so in a win-loss analysis, I always want to make sure that I understand at the detail level, what their perception of value is.

Obviously, that's also influenced by your competitor. Make sure that you do that via a one on one interview, six to ten is all it takes, after that it becomes repetitive.

Conduct quantitative study [A] to identify feature preference by segment

The second step is to do quantitative surveys, and the first one is segmentation.

Qualify in and target right audience

Making sure that you really understand who your audience is. Again create a little community or a little audience that you can pull, that you can ask those questions.

Ask which value proposition works best and for relative feature preference OR ask for pain point trade-off

Make sure that you give them a few options as to the feature preferences that they have so that it becomes relevant to the segmentation.

Conduct quantitative study [B] to identify price point

The second part of the survey - I recommend you split those out, so segmentation first - the second part is identification with the actual price point.

Screen audience (ask the right audience)

You can then again have qualification questions - are you sure that whoever you are targeting is the right person? There are different mechanisms, you could acquire people via LinkedIn, work with panel research organizations, there's multiple ways that you can identify your panel, but make sure that you ask the right people the right questions.

Show video, screenshots, testimonial, description of offerings and ask what price points someone would pay for offering

Show them some screenshots of the actual product and ask them straight up, "How much would you be willing to pay?".

Methodologies exist out there to do this, the chart that I included earlier that was using the Gabor-Granger methodology, there is Van Westendorp, Conjoint analysis - a couple of different things that you can do, and then just get people to respond around how much are you willing to pay?

It gives you phenomenal insight and phenomenal data.

To summarise

Coming back again to this beautiful little chart I used at the outset, if any of this looks familiar to you, if you own the persona definition, if someone will consult, consider, influence you for the website, email design, campaign content, AB testing, etc. then you kind of already own pricing, you just need to figure out a way to activate a lot of that.

Follow us on LinkedIn

Follow us on LinkedIn

.svg)

Start the conversation

Become a member of Product Marketing Alliance to start commenting.

Sign up now