Before conducting a set of customer interviews, you must decide how much structure you need to impose on those conversations.

Will open, free-flowing conversations yield you with the insights you need? Or do you need to lead the discussion down a specific path?

To answer this question, first ask yourself why you are conducting the interviews:

- Are they a form of account management – one-off calls with customers to hear how they are doing and if they have any urgent needs or interesting suggestions?

- Are you getting yourself up to speed because you are new to the company or product team and don’t know what you don’t know?

- Are you doing them as research to inform a product marketing initiative?

The first two use cases don’t need a structured interview and are probably better off without one. Let the customer lead the direction of the conversation.

If the calls are intended as research, they will benefit from some structure. Here’s why:

Pitfalls of unstructured interviews

In wide-open conversations, it can be easy to inadvertently relinquish control over the conversation to the customer.

Let’s face it: it is hard to schedule an interview, so once you have someone on the line, you can feel beholden to them because they’ve agreed to give up some of their time for you.

The risk is that customers can go off on tangents or even rants that may be important to them but not necessarily helpful for what you are trying to do.

If you are trying to evaluate the opportunity for a new product feature, hearing about a customer’s frustration with the license renewal isn’t that useful. This is more likely to happen if you position the interview as open-ended, such as “I’d like to hear from you about how things are going…”

Without any structure, even you can take the discussion down really interesting paths, only to find at the end that you didn’t spend enough time on the topics that will help you with the challenges/decisions at hand.

Repeat this over several interviews, and you end up with a data set that lacks consistency and consists of anecdotes rather than trends.

Using a semi-structured interview helps you keep the conversation on track.

When a customer goes off track, you can gently tell them that what they are sharing is valuable but that you have some topics that you need to cover in the interview. It is easier to provide this type of feedback if it's true.

Assumptions and hypotheses

Any type of primary research, including in-depth interviews, tends to provide more actionable insights when used to test hypotheses and assumptions. This also provides the outline for a semi-structured interview.

Identifying what you need to validate and what you need to learn more about can be as helpful as the interviews themselves.

That said, articulating assumptions and hypotheses to test is easier said than done. The following framework can help:

- We believe our ICP has the following profile…

- Has these objectives…

- Experiences these problems…

- That are due to…

- And will value our solution because…

Once you’ve completed the framework, you can identify the areas where you feel confident in your understanding of the customer, where you need validation and your biggest informational gaps.

5-8 big questions

Depending on the amount of time you have with the customer (20, 30, 45 minutes), you should have 5-8 big-picture topic areas to cover in your interview. For each big-picture topic, prepare a series of supporting questions that you may or may not use.

These questions help prime you as the interviewer for what you should be listening for. They also help you keep track of things that are not said by the customer, e.g., you expected XYZ to surface as an urgent need, but no customer mentioned it spontaneously.

As a product marketer, common use cases for customer interviews include gathering customer requirements and evaluating interest in new features.

So, as an example, let’s assume you work at a company that provides inventory management software for mid-size industrial manufacturers. You want to understand how much value customers see in an AI-powered forecasting module.

Let's start the discussion by understanding their biggest inventory management challenges. So, a specific example you could ask is, “What are the biggest inventory management challenges you encounter?”

After their initial response, we'll want to explore any unmentioned aspects like:

To what degree are the following challenges for you and your organization?

- Accurately tracking inventory across plant and warehouse locations

- Integrating with supplier systems

- Not being able to forecast inventory needs accurately

The next big-picture question and follow-up for the inventory management software interview could be “What are the challenges you encounter when trying to forecast your inventory needs?”

Listen for pain points around fragmented data in legacy systems, manual spreadsheet forecasting, and fluctuating customer demands – probe on any areas they don't bring up naturally.

Finally, we'll explore their reaction to our proposed solution: "How useful would a forecasting tool be that includes these capabilities?" Guide the conversation to understand if it would address their current challenges, surface any concerns, and identify what additional features would make it valuable for their operation.

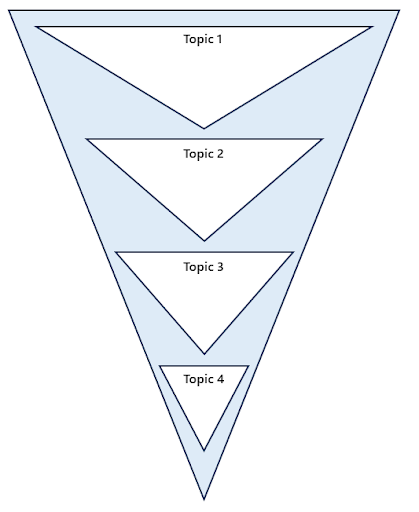

As demonstrated in the example below, a semi-structured interview can be visualized as a funnel that consists of a series of nested triangles.

You start with the first big-picture topic and drill down as time allows. Then, you expand back to the next big-picture topic, usually narrower than the first, and repeat the process.

"What keeps you up at night?" is often too broad a question that may yield responses unrelated to your solution.

While this open-ended approach can be valuable in early exploratory research, it's usually more effective to focus the question on your specific area of interest. For example, asking "Thinking about your inventory management, what keeps you up at night?" will generate more relevant insights.

Remember that a semi-structured interview is dynamic, not a rigid survey. As an interviewer, you should feel empowered to adapt and adjust your approach both during individual interviews and across multiple conversations as new insights emerge.

Think of your interview guide as a roadmap: while there are many routes from Boston to New York City – whether by train, plane, or car – all paths lead southwest.

Similarly, while your interviewing style may flex and evolve, your core objectives remain constant. By the end of your interviews, you should have thoroughly explored all your key questions and be able to distinguish between meaningful patterns and isolated anecdotes.

Follow us on LinkedIn

Follow us on LinkedIn

.svg)

Start the conversation

Become a member of Product Marketing Alliance to start commenting.

Sign up now