Launching a new product comes with plenty of challenges and the way we’re launching products as PMMs is shifting; it’s getting faster.

In this article, I’m going to focus on how you launch a new product within an existing culture. I want to share my experiences launching a new product within a billion-dollar company and take you through the nine key lessons learned along the way.

I've learned that launching a new product, like a startup, inside a billion-dollar company has some challenges.

In fact, you can think of it like driving a car in first gear, you could really rev the RPMs, there's a lot of activity, but you're not really going that fast, you're burning a lot of fuel and it's not very efficient.

What I hope to do in this article, is share some of the things that we've learned in going through this process of launching this new product.

Shifts in GTM

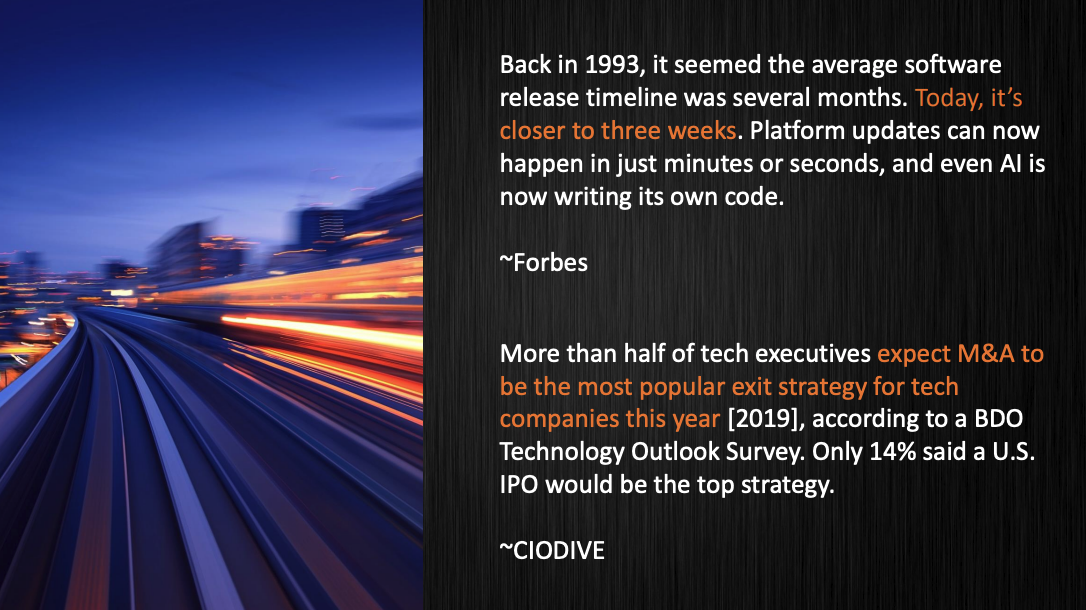

One of the things I think is happening and affecting all of us as product marketing people is there are actually shifts in how we're going to market with products.

First of all, products are becoming much faster, or the pace of product launches are becoming much more rapid.

I looked for some quotes and I found some good ones. One is from Forbes saying that today, it's closer to three weeks for product to update. Our product launch is four weeks right now, or every four weeks we have a new release and a new update. Years ago this would be six months, maybe a year, maybe longer.

The second part, as you can see at the bottom, talks about mergers and acquisitions.

Today, there's a rapid pace. Maybe today you're not in the situation that I'm going to describe in my article but either through advanced and rapid product development and release or through merger and acquisition, you might find yourself in the situation that I'll describe.

At that point, hopefully, this article can help you out.

Billion-dollar infrastructure

To begin, let me show a picture of what I mean when I write about a billion-dollar company or an enterprise-level company. It's a little different from a small startup company.

In a small startup company, you make a change to what you're doing with marketing or messaging, you can look across the table, you can talk to the people, you can make an update, and you can move on. Here we're talking about an existing infrastructure that takes place.

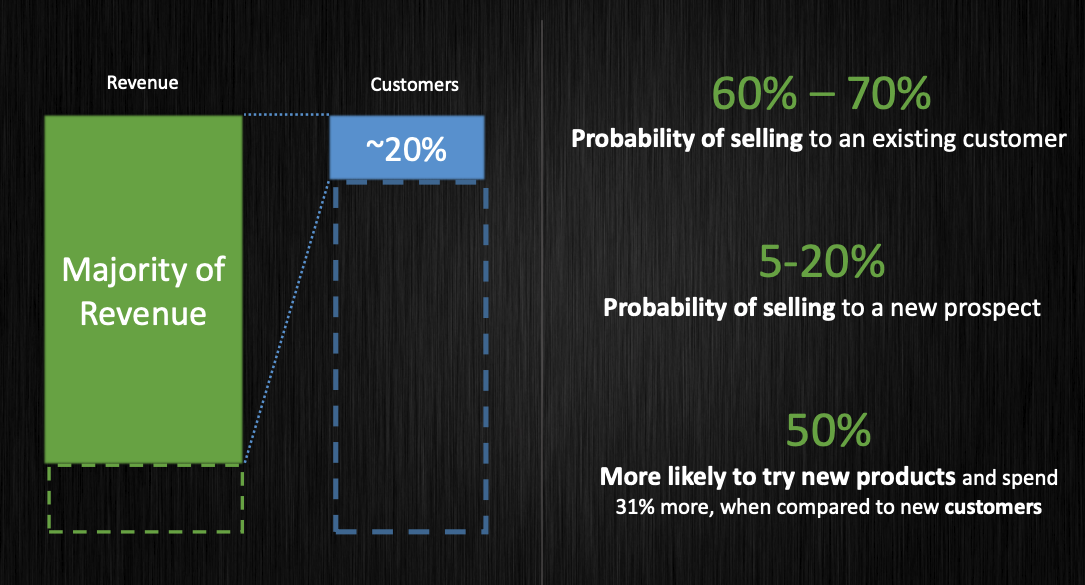

One of the things that I want you to keep in mind with this infrastructure is that, like other companies, where 60 to 70% of your new selling goes to existing customers, with a billion-dollar enterprise company, that's very true.

We have existing customers, in some cases, our top 20% of our customers might account for a large majority of our revenue. When you have a situation like this, you're still obviously going out and looking for new customers, and you're looking for new logos but there are some infrastructure and processes in place that you must adhere to, and you must think about.

That's what I'm going to take a look at when I through these things.

How to launch a product within your existing culture

What I'd like you to consider today is how do you go about launching a new product within your existing culture? How would you think about this, if you happen to find yourself in a new company through merger and acquisition, or perhaps you switch jobs and go to a larger company?

I'm going to focus on three areas, give you three insights, and then give you some nine lessons learned that you can take away.

Before I go there, what is my company and what do we do?

About PTC

My company is PTC and we sell software to industrial companies. What is an industrial company? An industrial company is somebody who makes something.

At home, you have a dishwasher, or you have a microwave, or you drive your car, or out in the farm there's a tractor - those are industrial type products, they have to be designed, they have to be brought to fruition, they have to be built, and then they have to be sold.

Those companies like John Deer, Airbus, and Toyota, those types of companies are the ones that we sell our products to.

What are we working on here at PTC? We're working on augmented reality and some people consider this the fourth platform wave when it comes to communicating product information or just information in general.

You might say what are the first three waves?

- The first one was PC, so just a personal computer.

- Second platform wave many people consider to be mobile – so we got on our phones, we can move around.

- Third platform wave was social – now you're starting to collaborate and talk to folks.

And then the fourth platform wave, people believe is going to be augmented, and mixed reality.

Why is that so important?

We believe that augmented reality is going to fundamentally change the way we communicate product information. If you buy something at home, you buy a vacuum cleaner or a dishwasher, what comes in the box with the vacuum cleaner or the dishwasher?

The manual. You open the box, take out whatever it is, and then out comes this manual. What do you do with that manual? You throw it away.

That's what 90% of the people tell me - you throw that away. Then what happens about eight months later, when the thing breaks down? You go to Google, and you hope you typed in the right number, and you hope you typed in the right information.

Imagine instead, that you could take out your phone, point it at your refrigerator, and it would start to light up and tell you all the information about your refrigerator, and how to fix it and change the air filter. That's communicating information about that object, about that product, and that's where we're going.

It gets even more interesting because as you can see in the image above, today when you design a product, it comes with some sort of interface - buttons, numbers, knobs. We can actually control devices through augmented reality now, so we don't need the interface.

In the future, you might have products that are designed more for fit and function rather than having to worry about how the operator interfaces with it. Instead, you put on glasses, and you could see your interface to your devices.

You might say, "Hey, that seems a little far in the future." But if we talked to people 15 years ago about carrying a phone around in your pocket all day, every day, they'd say you're crazy. That's where we're going and this is why it's so exciting to us fundamentally changing the way we're communicating product information.

How did we get this technology?

Well, my company bought it, it was a merger and acquisition, we brought that technology in, and we bought it in November. In December, we put the team together and in January, we met in Blaine, Minnesota, and we sat down and we started thinking about the product and how we launched the product.

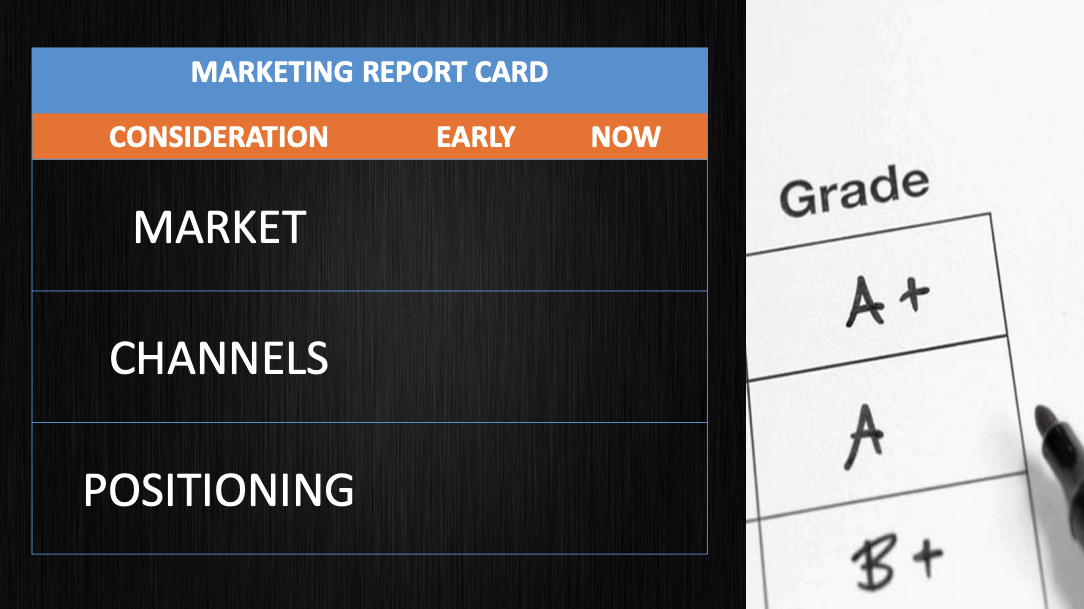

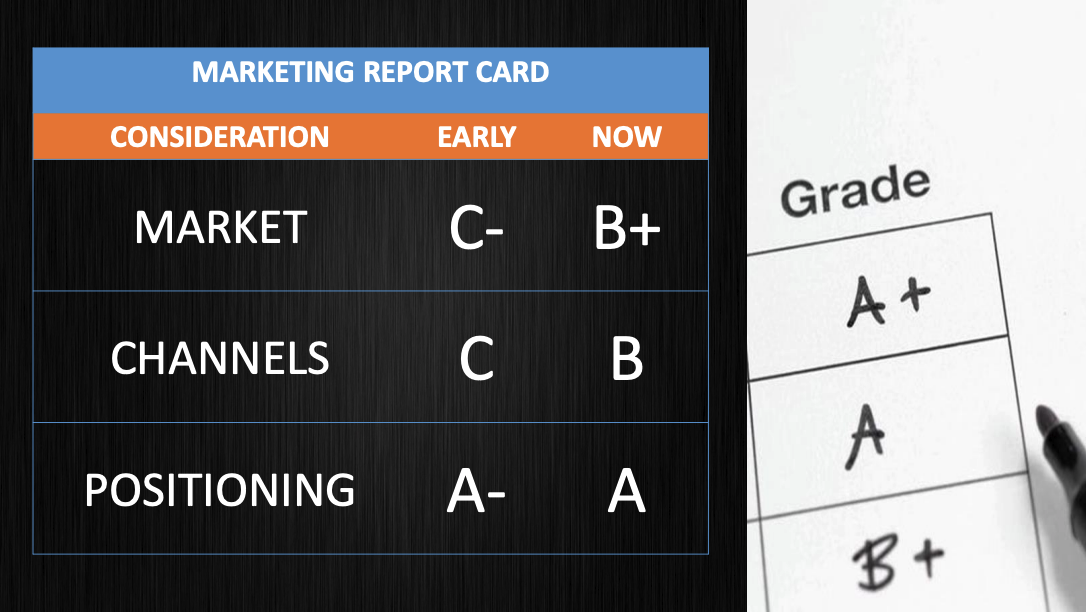

I want to go through three areas with you. I broke them down into general areas.

- The first area is thinking about the market. This would be your buyer, your target audience, the product, and things that go into normal general terms.

- Channel, I'm really talking about how we sell the product.

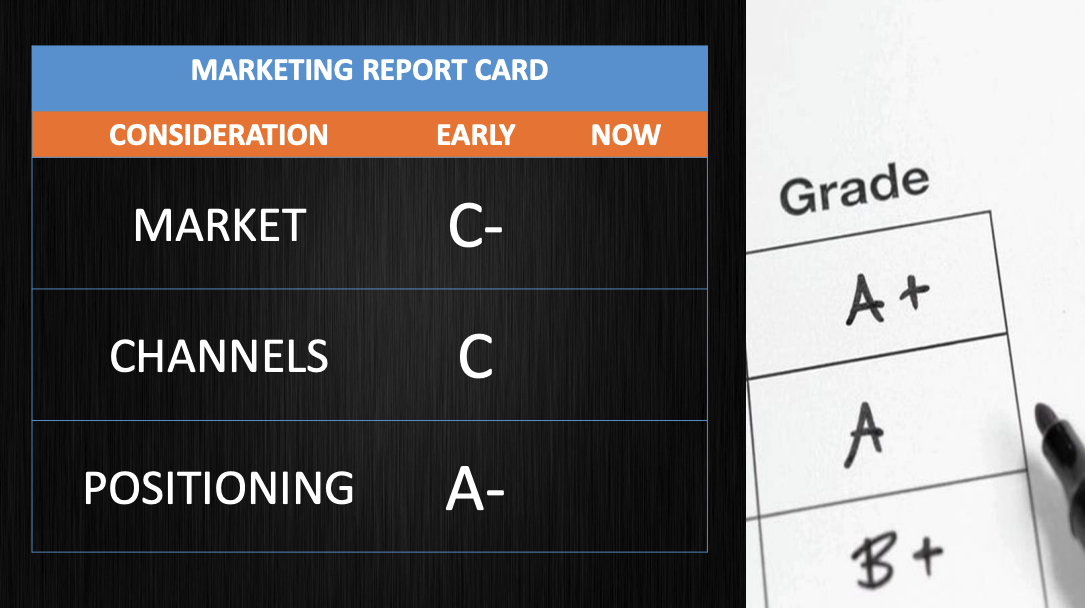

- Positioning encompasses brand, messaging, and all that material. I broke the scorecard down into early, which is in the first year or year and a half. And then now which is the last year and a half.

What did we do early? I gave us some grades. If my colleagues saw these grades, they might say, "Hey, that's a little harsh there, Matt." But I think this is accurate on how we were able to bring this product out to market.

Now I don't want you to think these are bad. We actually did well, we met our plan, we're selling the product, we're actually doing very well, we're selling more and more, and customers are really embracing it.

These grades are not about the results, they're about product marketing, and some of the things that everybody reading has to deal with. Let me go through these three areas and I'll tell you some of the insights.

Market

The first area I call market, but basically again, who are we selling to and who are we talking about? What's the difference between a startup and this billion-dollar company?

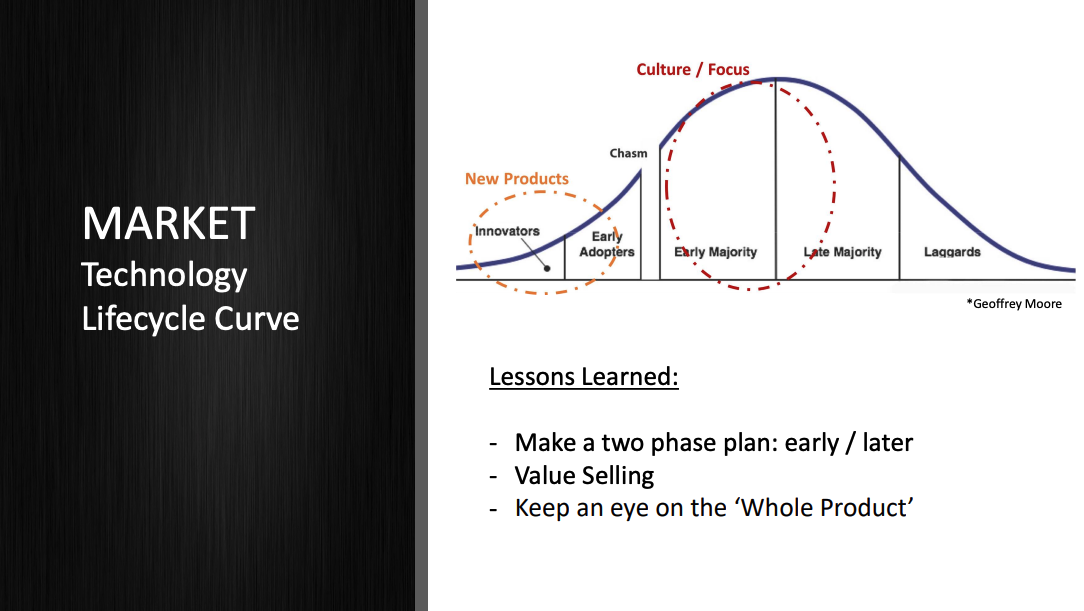

Technology lifecycle curve

The graphic you can see is the technology lifecycle curve. This is Geoffrey Moore and his book Crossing the Chasm. In that book, he talks about what it takes to bring a technology company to market. He really talked about it back in the .com era, but if you haven't read that book, it's worth a read because he talks a lot about what some of the challenges are in bringing a technology company to market.

In the book, he has this famous technology lifecycle curve, and at the beginning of the curve are the people who – when you have new technology – you want to get it in their hands.

These are the innovators. These are the visionaries. These are the early adopters.

The innovators

The innovators are people who love technology. In the book, he talks about when the first home computer came out, it actually showed up in a kit, you had to assemble it yourself. Yet there were tonnes of people lining up to get this kit to assemble it themselves. They're the innovators, they want their hands on the technology.

The early adopters

The early adopters, in every company that you go to, there's somebody who's driving some sort of transformation, they want their business to get better. Usually, they have money, they have access to some budget, so they're willing to buy early versions of products, and get it in the hands of their customers.

Now, they don't stay very long, you hear people like "I'm on my ninth startup" because they are constantly trying to turn the wheel and move it forward. So this is the beginning part of the curve.

The chasm

Then there's the chasm, which in the book talks about the challenge of going from early adoption to actually into the mainstream every day, the majority of people are going to use the product day in and day out.

This is where you get your revenue and this is where you start to make a margin. This is where you start to get some higher sales.

Here, there's a totally different buyer, this person is a pragmatist, this person is somebody who cares about the bottom line, they run the business day in and day out, they have to keep the lights on and care about the actual operating costs down to the dollar.

You have different criteria when you're selling to that group, you have to have a lot of references, you have to have a lot of proof points, and you have to make sure that you understand their complete situation.

When you run a startup, you're on the left, which is great.

But when you're selling into this realm of an established business, it gets a little challenging. When you have an established company, our sales reps, which we have a direct sales force, have spent a lot of time building relationships with the folks in the red circle.

They have staked their relationship on delivering results to the folks in the red circle. So now you take a new technology, which is over here, this is a totally different set of people you're talking to.

Lesson #1: Make a two-phase plan

What we learned is we needed to really think about both groups almost simultaneously. We started on the left and instead had to move later into this red circle.

My first lesson learned is – you might want to make a two-phase plan, if you're dealing with salesforce that has established B2B sales practices and has relationships but you're coming out with a new product, you still want to get mindshare, you still want to get excitement, but you’ve got to think about how that sales rep is actually talking to the product.

Lesson #2: Value selling

The second lesson learned here is value selling. One of the things that we did in the beginning with our new product was we ran a beta program, and we got lots of feedback.

With a hot technology like augmented reality, we had no problem getting beta customers. In fact, we said we would cap the beta program at 12 customers then we went off and looked for it. Every rep came out of the woodwork from around the globe and said "No, no, you don't understand my customer is supercritical. You got to get them in this beta program".

We recapped it at 24, then we recapped it again at 40, and finally, we said we're done. We had 40 beta customers directly giving us feedback on product management and product marketing. The whole time they were telling us about this feature – what they needed and how they were thinking about it. That's really important.

Then we launched the product, we went out into the world, no problem getting meetings, no problem getting people to invite us in to talk about it. Everybody wanted to see augmented reality, it's fun, and you put it on the ground.

But then we said "Great, how are we doing on the deals?" And they said, "Well, they haven't bought it yet. They haven't figured out how to connect the dots."

We realized and we went back and had to reprogram ourselves to really define the value that we were bringing with this particular product. Especially because it was such a visual fun product. People were getting wrapped up in that and they weren't connecting the dots down into the value that took place.

Another valuable lesson here, if I had to go back and do the beta program again, I'd say you want to do a beta not just for product, but a beta for value. Can you actually understand the value that the customer is asking?

When I'm talking about value, I'm talking about dollars, dollars to the customer. If someone says to you, "Hey, we really need that feature." That's great, tell me why you need the feature.

If they just say, "Well, I need that feature because my users want that feature." That's also good but then go one step further, "What does that actually mean to your business? Is it less cost? Less training? Less waste?" If you can't connect that dot, then putting a feature in there might not be valuable. So beta the product definitely but think about the value.

Lesson #3: Keep an eye on the ‘whole product’

The last item is keeping an eye on the whole product. Again, when you get from this part of the lifecycle curve, you can have some holes in the products, it's okay because these folks here are willing to assemble the kit, assemble the PC, they're willing to put on some of the heavy lifting that takes place.

But when you get over to the red circle you better make sure you have all the pieces lined up. It's not like we didn't have the pieces, but we just didn't have the pieces in a way that the salesforce could easily get to them very quickly, and turn around and deliver that.

Channels

The second area of three is the channel. This was how we were selling it.

The first thing that happens inside an enterprise company is you have lots of channels. We had a direct sales force: A high-value sales force and a velocity sales force and a partner sales force. We've got all sorts of ways and methods, resellers to get the product out there.

Again, with a very hot technology, everybody wanted to have access to it. Immediately, we said, "Yeah, this is great, we want to generate interest and mindshare, we want to get the product out there in the world." So we really didn't stop anybody from going out and doing this.

Lesson #4: Avoid the temptation to do too many too fast

What we found is that, again, they're talking to different people and different buyers in different places, as you would expect, and immediately, we started getting some feedback.

I had a person who went to Europe, went to one of our resellers and he was literally explaining to me that I didn't understand the market after we just spent a year researching everything, because he couldn't sell because we had put the product at a price point that didn't match his customers.

In reality, we had researched and come up with a price point that we felt was very conservative. But our channel force wasn't touching those customers. In reality, we said it might not have been the best to just open this up and hope that people understand the difference.

We should have thought about specifically, which sales force should be touching this product at which time? Sometimes the answer is no. Again, that might not be a challenge if you only have one direct sales force, or if you're going directly to a customer, but it's something to consider.

Lesson #5: Pricing alignment

The second item in channels is pricing alignment. We said we have a great new product, we should price it in a way that reflects this great new product, so we went out and came up with a new pricing methodology.

It was forward-thinking for us and it was forward-thinking for our customers. What we found is we spent more time answering questions about pricing than we did actually going about talking about the value and the product.

We decided we should go and do a lot of research on this. We went and talked to third-party folks, I went to a pricing seminar. In there, I heard from a person from Dell who had similar pricing to what we had and he spent 30 minutes explaining how they came up with all this new pricing and, at the end, one of the challenges we had was, that there was unpredictability built-in.

A customer might buy the product and then a year later, they might not know exactly how much they needed or how much consumption they had. This person at Dell went through this whole process and in the end, I raised my hand and said, "How did you handle that unpredictability?" He said, "That's what we're working on. We haven't figured it out yet."

Great so we're right there together.

What we learned is you can't just go and take what's an existing model. If you're going to go to your customers with new information, it requires education, it requires time, and it will lengthen the sales cycle time. We went back and we redid that and worked on putting pricing in line with the way our customers expect to buy it.

Lesson #6: Avoid "Do you want fries with that"

The last one here is when you have an established salesforce, that established salesforce has a quota. Inside of a larger enterprise business, a quota is maybe $1.8 million, or something like that in terms of product that you're supposed to sell for the year.

If you come out with a new product, and the new product is priced at a level that it's supposed to be mindshare and entry, so you put it at a low price point - you lose mindshare potentially with your salesforce.

Because if I have a $1.8 million quota, and I'm selling a $30,000 product, I'm not going to spend a lot of time on that. I'm going to spend time on deals that are hundreds of 1000s of dollars to get to my quota.

Back to the two points of that adoption curve, that lifecycle, we wanted mindshare, so we priced it low but we had a salesforce who was trying to sell at a high quota. What ended up happening?

Super hot technology, as I said, and so the salesforce would still go in, they would still have deals, but the customer would say, "You know what, that really super high technology you have, give me some of that too" and the rep would put it on the quote and say, "Okay, great, we'll give you some augmented reality on the quote."

One of my colleagues turned the phrase, "Would you like some fries with that?"

That's great but that actually was messing up in terms of what we were seeing as an impact in launching the product because now we were seeing deals rolled through but they weren't actual deals that were connected to value within the customer.

They were deals that were showing up because the salesforce was able to put some additional money into it.

Positioning

Here I gave us an A-minus because what I can say is that with our new technology, a very hot technology, we had no problem, as I mentioned, getting people to think about it.

Lesson #7: Capturing mindshare works when everyone is involved

In fact, the entire company was very excited about it. We had our HR department doing AR scavenger hunts, we had our CEO who's a super visionary guy email our entire company and say, "Here, try this product out."

We had the sales reps doing it on their own – people who would not normally touch technology going into customers and showing customers how it worked. We had no problem gaining mindshare, we had lots of analysts who wanted to come write about it and talk about it.

Again, it bolstered their position, there was a super hot technology, and they came and got the information from us.

Creating mindshare when everybody is involved was extremely valuable, and helped us continue to push this out into the world.

Lesson #8: A strong vision drives customer connection

The second thing that came out of this was a strong vision drives customer connection. The story I told you about throwing away the manual, when we brought that to our customers, they all saw that vision.

They all wanted the vision and we haven't wavered from that. Even though we've adjusted and moved other things around over the past two years, we've never wavered from the vision.

I think if you stick by the vision and who you are, then you can move the other pieces around and still be successful.

Lesson #9: Market maturity

The last thing we learned is that when you have a new technology, you have to spend a lot of time educating the market. Some of our sales enablement started with selling and then we turned it a little bit more to how do you educate? And then we turned it a little bit more to again, how do you educate and connect value?

There has to be some sort of market maturity in there and in this case, it took a little bit of time, but now we're seeing customers coming to us and telling us that they want to participate in this technology.

KPIs early

If I go back to my scorecard, this is what happened to us.

In the beginning, we had no problem with activities, no problem with leads, you'd look at our funnel and our pipeline, and you'd say, "Wow, that was amazing. You guys are doing great."

A lot of leads going through the funnel a lot of MQLs, SALs, SQLs. But in the end, if you look, we said for all of that activity, we should have more deals and we didn't.

Part of it was because everybody was really interested but they weren't sure what to do.

The other thing we saw was the deal size didn't go up because people were buying just enough to try but they weren't connecting it into their business. So they weren't increasing the number of deals.

Plus, our pricing, as I mentioned, was a little complicated. People were like, "Let me just take what I can at the moment, and I'll come back later." As a result, our RPMs were high, with lots of activity, and lots of things happening, but we weren't getting necessarily the results that we were looking for.

What did we do?

We went in, and we made some changes, and today I give us a much better grade.

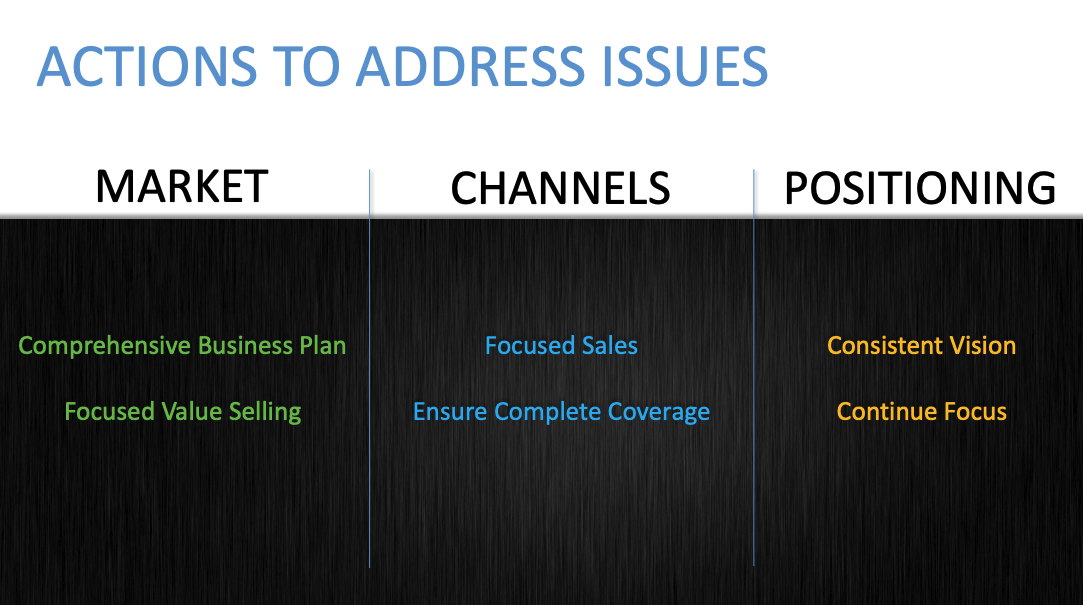

Actions to address issues

How did we do that? First, we went into these different areas and we changed a few items.

Market

In market, we developed a comprehensive business plan. We had a leader come from outside our company and she asked us to sit down and form a more comprehensive plan.

The plan being that early part but also the later part. We spent a lot of time focused on value selling. Connecting those dots. I would go to customers with our sales reps, to customers who had already bought our product, and we'd sit down with the sales rep and the customer.

The customer would look over at me and say, "We love your technology, it's fantastic. Can you help sell my boss that we should turn it on?" At that point, we realized there was a disconnect between what the customer thought the product should be doing and what it should be doing.

So we spent a lot of time helping connect the dots between here's what the functionality does, and here's why it's valuable to your business.

Channels

We went back to our channels, and we focused, we went into the people who we felt could actually achieve results. Even though it was a technology everybody wanted to touch, we backed that off.

We also made sure that we gave the sales reps a complete understanding of the coverage that they needed, and also what they needed to deliver to the customer.

Positioning

With positioning, we stayed with a consistent vision. We have a very strong vision in our company about fundamentally changing the way we communicate product information. We have a very strong CEO in terms of driving that vision.

If you're going to change something, change other items, but don't change the core vision – that will certainly help people stay on track.

The last thing is we continued our focus. Unlike other areas where perhaps we tried something and moved away, we kept at it and kept adjusting and kept moving forward until we delivered something that was valuable.

Today, it's a much better scorecard.

KPIs afterwards

We still have tremendous activity, we still are driving a lot of leads, our deals continue to go up, but they go up more relative to what we would expect versus the activity in the leads, and our deal size has also gone up as we continue to adjust both the pricing and how we sell focusing in on that value selling.

Summary

Three areas; market, channel, and position.

I've talked about three items in each one of those areas and I really want to emphasize the difference between a startup where everything is really new in the technology and being inside an environment where you have established processes and established salesforce.

Whether or not today you're there, you might be there tomorrow, if somebody acquires your company, you might be there tomorrow if you acquire a company and now become responsible for that group.

You might be there just because your product is evolving so quickly that six months from now you change it up again and now your salesforce is that much more mature, and you have to work with them.

I hope that some of the things I discussed here will help you out and in the end that your RPM is a little lower, and you're running a little more effectively.

How to improve your Go-to-Market knowledge

Delivered by Yoni Solomon, Chief Marketing Officer at Uptime.com, Go-to-Market Certified includes everything you need to design, launch, and measure an impactful Go-to-Market strategy.

By the end of the course, you'll be able to confidently:

🚀 Grasp a proven product launch formula that’s equal parts comprehensive, repeatable, creative, and collaborative.

🧠 Gain the expertise and know-how to build and tailor an ideal product blueprint of your own.

🛠 Equip yourself with templates to facilitate a seamless GTM process.

Follow us on LinkedIn

Follow us on LinkedIn

.svg?v=176eabd947)