A suitable product selling price is key to your success. If you’re underpriced, not only will you lose money, but your product could also be viewed as cheap and unreliable. On the other hand, overpricing your product means you run the risk of pricing yourself out of the market.

So, what’s the solution?

You need to price your product in such a way that’ll secure your place in the market, satisfy your customers, and give your business scope to thrive and develop.

In this guide to calculating product price, we’ll focus on topics such as:

- Differences between cost-plus pricing and target costing

- Pricing strategy advice

- What to consider when pricing your product

- How to generate profit

- Resources to develop your pricing knowledge

What is a product selling price?

A product selling price is how much a customer pays for a product/service. Prices vary depending on how much customers are prepared to pay, the amount of money the seller is prepared to accept, and how competitive the price is when compared to other businesses.

How to calculate the price of a product: Important pricing formulas

Product selling price formula

To calculate your product selling price, use the formula:

The cost price is the price a retailer paid for the product, while the profit margin is a percentage of the cost price.

How to calculate the average selling price

Before calculating your selling price, it’s important to understand the average selling price of existing products already available in the market.

The average selling price can be calculated using the formula:

If your company is in the process of releasing a new game console and wants to position it as a high-end product, the average selling price of $500 for existing game consoles can be used to guide your pricing strategy.

You may price yourself at $550-$600, a higher price than your competitors, to stand out as a luxury (albeit more expensive) alternative.

How to calculate product selling price by unit

If your business stocks up on inventory in bulk, it may be worth calculating your product selling price by unit.

To calculate your product selling price by unit, follow these three steps:

- Calculate the total cost of all units purchased.

- Divide the total cost by the total number of units purchased - this will provide you with the cost price.

- Use the selling price formula to calculate the final selling price.

How to calculate the perfect product selling price: 5 key models

There are multiple pricing models you use for your product. Here are the most common models on offer - and how to select the right one to price your product.

What is a freemium pricing model?

The freemium pricing model involves offering a free version of your product to your customer, with the aim of steering your customers towards upgrading to a paid version. In some cases, freemium services incentivize customers to encourage them to sign up for the paid version.

Music streaming service Spotify is the perfect example of a freemium pricing strategy, offering its users an option to use the platform for free, with the caveat of advertisements between songs and limited song skipping.

Oftentimes, this'll prompt users to bite the bullet, put their hands in their pockets, and sign up for the paid version.

When should a freemium pricing model be used?

The freemium model's primary purpose is to attract new customers and is mainly used for digital products, not physical products.

It's essential for your product to appeal to large-scale, mass markets, and needs to provide an exemplary user experience.

Moreover, it's vital that you don't give too much away in your freemium plan; if you give too much away, then users won't have the motivation or drive to spend money on the paid version. You also must be able to balance your resources until your initial freemium customers upgrade.

Before you give anything away, take the time to analyze your data, so you can assess which features you ought to be dishing out free of charge. After all, you don't want to give your prized assets away for nothing!

What is tiered pricing?

Tiered pricing models offer customers the option to select a cost option to suit their needs.

The tiered pricing models are often broken down as follows:

- Freemium

- Individual

- Duo

- Family account

- Student

When should a tiered pricing model be used?

Tiered pricing models are used by companies to generate appeal amongst a broader and more diverse customer base.

This model is ordinarily used for digital services as it helps orgs fulfill the requirements of a range of target markets.

What is a flat-rate subscription?

When a customer signs up for a flat-rate subscription, they pay a fixed price, regularly, in exchange for a particular set of features and services.

For example, when a customer signs up for a mobile phone tariff, they pay X amount per month, in exchange for their data allowance, minutes, and text messages. If they cross their allocated threshold, they're then charged a surplus fee to cover additional costs.

When should a flat-rate subscription be used?

A flat-rate subscription is best suited to products that have limited features and are targeted towards one buyer persona.

What is bulk pricing?

When bulk pricing is applied, the price of a product decreases, as the amount of products or services increases.

Otherwise known as volume pricing, bulk pricing incentivizes customers to purchase more, as it proves to be more cost-effective - the more they buy, the more they save.

For example, a clothing company may charge $10 for one pair of socks, but reduce the cost to $8 a pair if a customer buys five pairs. This is appealing to the buyer and can generate more sales, as it represents a saving of $10.

When should bulk pricing be used?

More often than not, bulk pricing is used by companies operating in B2B and wholesale.

What is market pricing?

When companies use market pricing, the price of their product alters in line with supply and demand.

Taking this into account, it's essential to conduct competitive intelligence and understand exactly the pricepoints being applied by market rivals.

In this case, the customer isn't a contributing factor at all. The price you set is guided exclusively by competitor activity and market saturation.

There are multiple market pricing examples you're sure to have encountered in practice, with the model commonly used by car manufacturers, smartphone companies, and streaming companies such as Spotify and Netflix.

When should market pricing be used?

Market pricing should be used when your product is similar to that of your competitors’.

Implementing this approach gives you a specific, clear-cut price point to work with. However, to be successful when using this method, you have to nail your positioning, refine your messaging, and ensure your product's viewed as the superior option within the marketplace.

Tap into the six steps to the perfect pricing strategy.

👉 Download your free copy

Types of pricing strategies

Product marketers have several pricing strategies to consider, including:

- Competitor-based pricing

- Cost-plus pricing

- Value-based pricing

- Dynamic pricing

- Penetration pricing

- Price skimming

- Target costing

Cost-plus pricing is often considered one of the most simple methods on offer, but target costing is another method used by PMMs when mapping out their pricing strategy.

Before we move on to look at the difference between cost-plus pricing and target costing, let’s define target costing and cost-plus pricing.

What is target costing?

Target costing is defined by the Chartered Institute of Management Accountants as: “a product cost estimate derived from a competitive market price.”

Target costing is categorized as a management technique, as well as a pricing method, in which price points are influenced by the condition of the market, and other key factors, such as homogeneous products, the volume of competition, and no/low switching costs for the end customer.

Example: How to price your product using target costing

Imagine you have a business selling customized soccer jerseys, and the average market price is $200. Here’s how to calculate your target cost:

Average market price: $200

Target margin: 50%

Target cost: $100

Because your target margin is 50%, the maximum amount you can use to produce each product is $100. If it costs more than $100 to manufacture each customized soccer jersey, this will reduce your margin.

You may be asking yourself: “How do I determine the appropriate margin?”

While there’s no quick fix to determine an appropriate margin for your product, the standard margin is 40-50%.

Alternatively, you can use the price multiplier method to calculate your margin. Simply multiply the total costs by 2 (100% markup or 50% margin) or by 3 (200% markup or 67% margin). This will help you establish a suitable markup to put on your product.

If your product is unique, you’ll be able to charge a higher margin.

What is cost-plus pricing?

The cost-plus model is when companies add a percentage of profit to costs.

For example, if the total cost for a pair of trainers is $60 and a company wants to make a 30% profit on each pair, the cost per item would be $78, with an $18 profit.

This model is more commonly used among physical products because their material costs can be easily identified; the same can’t necessarily be said for SaaS products. Nonetheless, if you’re a SaaS business trying to follow this model, look at costs like people’s salaries and the number of hours spent building your product.

Pricing based on these costs will more than likely rely on a level of assumption. So, why do orgs lean towards this approach?

Cost-plus pricing pros:

Cost-plus pricing is simple and generates profits.

However, if you apply this model and your costs increase, there’s a direct correlation to your customers’ price increase too.

Cost-plus pricing cons:

The key disadvantage of cost-plus pricing is it doesn’t factor your competitors into the equation. By ignoring competitor pricing, there’s a good chance you could end up charging considerably more and achieving small profits, or considerably less, and giving away potential profits.

Another problem with this model is it doesn’t encourage the people who are building your product to be prudent. If your costs become too high, your retail price will also increase, and you could drive away your target personas.

Cost-plus pricing also doesn’t consider the customer, what their perceived value of your product is, or how much they’re willing to spend - it’s very company-centric.

Finally, although price increases might be easier to justify if the price of materials etc. rises, you have no control over how often and by how much these costs will go up.

There are only so many times you can increase your price before customers start to complain, and if you don’t reflect the difference in your price, it’ll eat into your profits. It also doesn’t account for unknown costs that come as you grow like marketing, sales, and new hires.

Differences between cost-plus pricing and target costing

Target costing operates completely differently from cost-plus pricing. When using this model, you start with the market prices to decipher the limit of the cost you can use to create your product.

To determine the market price, base this on an average. Conduct some competitive intelligence and use the information on the pricing pages of other companies to establish the price range customers are willing to pay for your product.

In some cases, your product won’t be a brand-new product, and there will be similar alternatives that have already been released. However, when companies release a pioneering product that’s not been released before, this puts them in a position to dictate the price in the market.

How to calculate gross profit margin

To calculate your company's gross profit margin percentage, subtract the cost of goods sold (COGS) from the net sales (gross revenues minus returns, allowances, and discounts).

Then, divide this figure by net sales and this will calculate the gross profit margin as a percentage.

Why is profit margin important to investors?

Investors are interested in your net profit margin because this allows them to assess if your company is generating enough profit from your sales.

When you’re calculating your net profit margin, it’s important to consider overhead costs and fixed costs. These cover raw materials, salaries, insurance, utilities, etc. have been factored into the equation.

Business owners need to take into account that irrespective of whether you’re a small business/startup or an established enterprise corporation, the net profit margin is one of the key cogs in your overall financial well-being.

Things to consider when pricing your product

There are multiple factors that will influence the pricing model you choose to apply when deciding on the selling price of a product.

For example, if you’re holding an end-of-season sale to clear stock, you’ll likely use a discount price model to introduce a lower price.

Similarly, factors such as sales volume and labor costs will also influence your product’s price, and different prices are often used depending on geographical location.

Taxes, cost structures, market needs, and exchange rates are likely to have a say in the price of your product in international markets. This often means the exact same product will have a higher price in location A than in location B.

Whether you’re a solo entrepreneur, an e-commerce business, or part of a large-scale company, you need a pricing strategy that’ll give you the right price for your product.

Don’t forget to factor in variable costs when deciding on the price of your product; it’s a simple way to ensure you don’t alienate some segments of your audience.

If you’re unsure whether you’re priced excessively when compared to similar products, don’t be afraid to use a pricing calculator.

Pricing calculators are a great resource for helping business owners establish if their sales price is fair and meets the expectations of the clientele.

Silvia Kiely Frucci, Senior Product Marketing Manager at Castor, shared five lessons she’s learned when pricing products during her career:

1. Follow the process but don’t be bound to it

Pricing is a complex matter and it cannot be driven just by qualitative insights. Creating a framework around the various pricing work streams is essential to get things done.

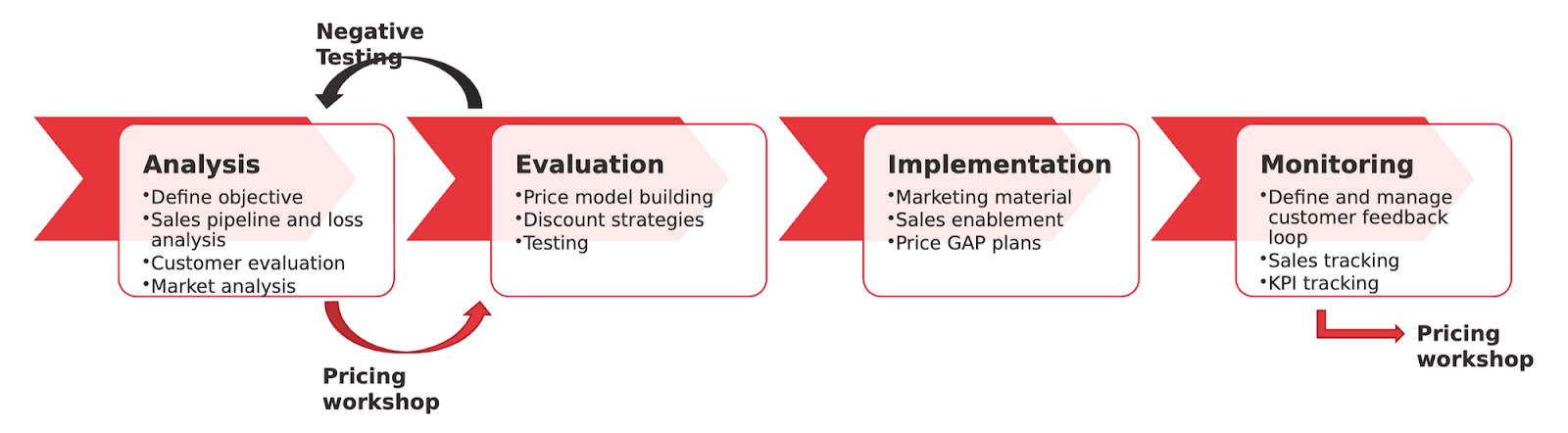

For the past two years, I have used the model below as a guideline:

Even if it looks like a linear process, milestones, and decisions are not always linked to the stage that the process suggests they should be dealt with.

For example:

- Relevant competitor information can be found after price testing with customers.

- The initial customer segmentation must be re-evaluated when new qualitative insights have emerged during a pricing workshop.

It’s important to always keep an open mind during the process to make sure your pricing output reflects the market needs.

2. Pricing is a team effort

Product marketers are often responsible for pricing but the process doesn’t have to be a single-handed decision.

Pricing workshops are the perfect ground to involve all the key influencers to discuss around the table. Product, sales, marketing, customer engagement, project management, and Business Unit Directors are all stakeholders in the success of the pricing strategy: they all hold a unique perspective on products, customers, and markets, and they all have very different KPIs around success.

Creating an open dialogue is the best way to hear everyone’s point of view and find a common strategy.

3. The perfect pricing structure is a myth

In the past I have built different pricing models: some were cost-plus only, others heavily relied on competitor pricing insights, and some were value-based.

There is no doubt to me that value-based pricing is the most successful way to price products, both in the physical and SaaS space.

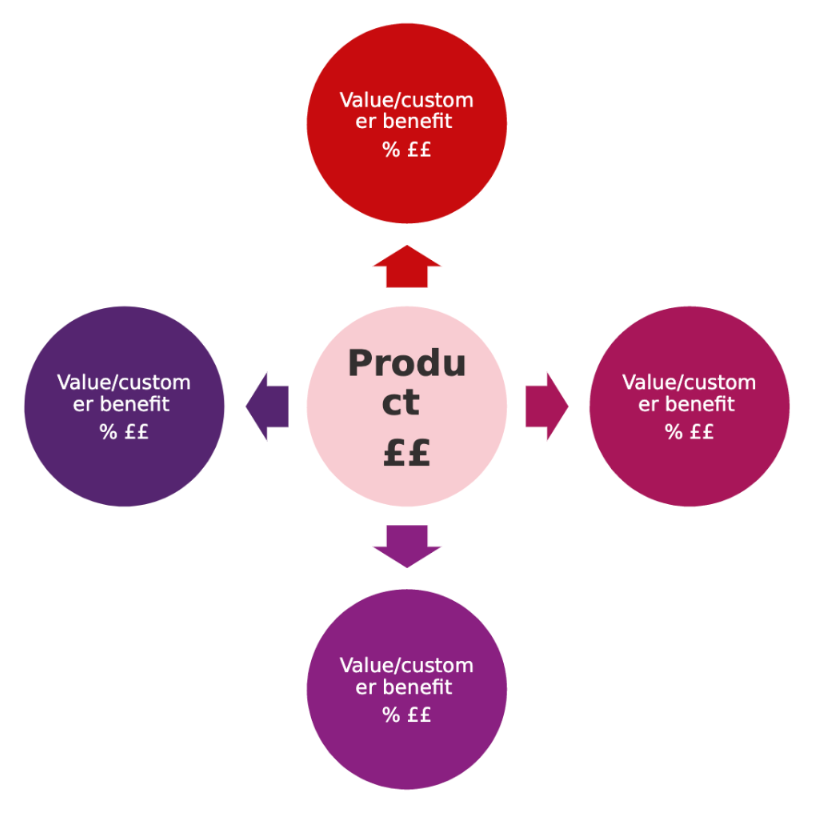

Value-based pricing best practices often show a 3-tier option with tick boxes for product features/benefits. Although this output is very clear and simple for customers it cannot be applied to every product: some products are so complex and/or so customizable they cannot be easily deconstructed to create different versions.

It is more the case of displaying value to the customers using a complementary pricing model where the final price is built by attributing a monetary rate to each customer-recognized value.

This model could be used as a guideline for discounting by asking the simple question to your customers: “Which value do you want to drop for a cheaper price?”

4. Negative price testing is the best ground to re-evaluate your product value proposition

I find price testing one of the most complicated processes to plan. Is it best just to live test and look for customers’ behavior in response? How about creating customer panels before roll-out? Will you test on renewals or new business? The questions are infinite.

Whichever strategy you select for the product you are selling, make sure you create a clear way to capture customer feedback: define 1-3 items that will help you define customer product perception in response to your pricing and align it with your product value proposition.

Great pricing means the customers have understood your product the way you and your company see it.

5. Pricing is not just a number

Making plans to roll out the price to the rest of the company is as important as deciding the price itself. One of the never-to-be-missed actions from the pricing workshop is agreeing on a clear strategy around sales enablement: In my experience, partnering with your marketing team at this stage is paramount, they will help you shape the message internally and to the customer.

How to generate profit

Companies have one thing in common: they all want to achieve their desired profit - without introducing a low price!

There’s no doubt a suitable product selling price plays a crucial role in helping them achieve these objectives.

In his presentation, How to Price for Growth and Profitability, Yannick Kpodar, Global Director of Product Marketing at PayFit, outlined his step-by-step process to identify the best pricing strategy for company growth and profitability.

Ultimately, there’s no definitive answer on how to price a product, and as Phill Agnew, Senior Product Marketing Manager at Hotjar suggests, it’s a complex area where many companies make mistakes.

You need to utilize a pricing strategy to drive cash flow. To do so, you’ve got to be clear on:

- The cost of producing your product

- The value of your services to your clients

- How much your customers have and want to spend

- The overall running costs of your business

- What critical costs need to be covered short-term (e.g. loan repayments)

- How your competitors price their products

Pricing needs to take every one of these principles into account to drive optimum profit. You may have to go through your business plan with a fine-tooth comb and consider factors such as brand development, team restructuring, etc. before you can draw a definitive conclusion.

Remember, your pricing strategies and product selling price are by no means definitive. You should continually assess your plan and make changes whenever something isn’t working as you anticipate. Your decision-making process can be dictated by simple metrics such as sales figures and churn rates.

Resources to develop pricing knowledge

Product Marketing Certified: Core, PMA’s certification program, features 11 modules and 10+ hours of learning, with an in-depth section focusing on the essentials of pricing including:

- Pricing basics

- Calculating your baseline

- Cost-plus pricing

- Competitor-based pricing

- Value-based pricing

- Dynamic pricing

- Price sensitivity surveys & conjoint analysis

- Pricing and packaging roadmaps

With on-demand, live and online, and team courses available, there’s an option to suit your preference, whatever your requirements. You’ll also get access to templates that’ll help you ensure the price of the product is suitable.

For more information, sign up for a live demo, discover what’s on offer, and ask any questions you may have.

Alternatively, register now, get certified, and enhance your practice with your newfound pricing knowledge.

Pricing strategy advice

There are many stages involved from the inception of an idea to a product launch, and pricing can dictate the success of your product.

Ashley Murphy, Toast's Senior Director of Market Insights and Pricing, shared her specialist insights, including her preferred pricing strategy, and the role of product marketing in the pricing process.

Q: What sort of pricing strategy do you use? And how (and how often) do you go about validating whether or not it's working?

A: “I typically encourage a value-based pricing strategy. This type of strategy is centered around customers’ value drivers and willingness to pay. Competitive dynamics and unit economics are the other two levers I consider to ultimately set price metrics and price levels.

“In terms of validating pricing, different tactics are depending on how much time/resources you have and the level of rigor you are looking to achieve.

"For major price changes, I recommend forming pricing based on historical trends and primary research with customers followed by in-market testing (i.e. regional tests with sales or A/B tests on the web). I recommend companies revisit their pricing bi-annually or annually, at a minimum, to stay relevant.”

Q: How big of a role does product marketing play when it comes to pricing at Toast?

A: “Big! I lead a dedicated team within the product marketing organization focused on pricing and packaging.

Pricing itself is very cross-functional, but my team is responsible for setting our pricing strategy, executing pricing experiments, and continuously evolving our pricing, packaging, and promotion approach. We work closely with core product marketing, product, finance, and sales.

“I’ve seen pricing live on many different teams (or sometimes nowhere/everywhere). I am a proponent of product marketing championing pricing as it will be deeply rooted in customer needs. Typically product marketing has the deepest sense of why you win/lose, competitor dynamics, and insight into the ‘voice of the customer.’

“If you work at a multi-product company, it is especially paramount that you form a dedicated pricing team so that the pricing of individual products are coordinated and work together to hit your goals.”

Q: I'm very new to the world of pricing and am starting a new PMM job in a B2B SaaS org in a few weeks where I know pricing will be a part of my role. What would be your best advice to a complete newbie?

A: “My #1 piece of advice is to build pricing processes (as opposed to tackling it one-off). Many organizations let pricing be based on gut or just debates between teammates. Establishing formal processes of how/when pricing decisions are made will set you up for long-term success!

“A few ideas that have worked well for me: I recommend creating a new product pricing playbook. Similar to how PMM will traditionally have a product launch playbook/process, you should also establish how pricing analyses and decisions will be made throughout the development process. Many companies wait until GA to make pricing decisions, but you should be considering pricing from the initial inception of a product.

“I also would recommend creating a pricing committee if you work for a mid/large size company. Pricing impacts many departments and therefore many folks will want to weigh in.

"Creating a formal pricing committee that helps prioritize the pricing roadmap and approve pricing decisions will help drive transparency and help you get things done more efficiently!”

Q: What are some strategies to start converting my B2B computer hardware business model from cost-plus to value-added pricing?

Some management and customers are set in this pricing model and we can't seem to get out of this cost-plus approach. If anything, I think everyone believes MSRP will increase due to value-added pricing, but some of it may decrease.

A: “Many companies go through this transition. The best way to get buy-in is to prove the business impact through data. I recommend doing in-market testing when shifting to value-based pricing. I typically suggest testing new pricing strategies with prospects to gauge demand and impact on unit economics before changing pricing for existing customers.

“Also, with value-based pricing, it is often beneficial to have a portfolio approach to pricing. If your company has many SKUs/products, the MSRP will likely both increase and decrease. The important thing to test is that as a portfolio, you are increasing your KPIs (revenue, margin, location acquisition).”

Q: What are some trends in pricing transparency on your website? And related —as someone moving to a global/enterprise offering— how might I think about the strategies for this differently from SMB strategies?

A: “In general, I recommend price transparency for lower complexity offerings. Buying habits have certainly shifted over the past few years and consumers (B2C and B2B) prefer to do their research online and I believe expect a certain amount of transparency and autonomy. That said, for enterprise/robust offerings that are often customized based on the customer’s needs, it is often difficult to display pricing on a website that applies to everyone.

“Using these principles, we publish pricing and offer the ability to buy online for SMB buyers. For SMB buyers we publish a starting rate, but still encourage prospects to meet with a consultant for a custom quote and price based on their needs. Lastly, for enterprise buyers, we do not publish pricing on our website given the high degree of variability and customization required for that segment.

“In short, price transparency will depend on the buyer and the complexity of their needs!"

Follow us on LinkedIn

Follow us on LinkedIn