In this article, I’ll share the story of Culture Trip’s Cultural Mindset study, and how Mars and Venus, or market insights and data science, can not only research but collaborate to help organizations target and communicate with customers in a way that helps them be understood.

I’m going to be discussing:

Product marketing: daddy or chips

In the 90s, there was a wonderful marketing campaign that McCain ran. It was called Daddy or Chips, it was a little girl who had to choose between hugging her dad and eating McCain chips.

Life was so simple in the past, we had product and we had marketing. We had daddy or chips.

Then we chose the hard route and became product marketers.

We have a profession, we have a function, we have a role. We did choose the very hard life of choosing daddy and chips, product and marketing but I think it is probably the most rewarding function in business today because it combines so much of customer empathy, market research, commercial, go to market, marketing, growth, and product.

I can't think of a better way to drive business outcomes.

About Culture Trip

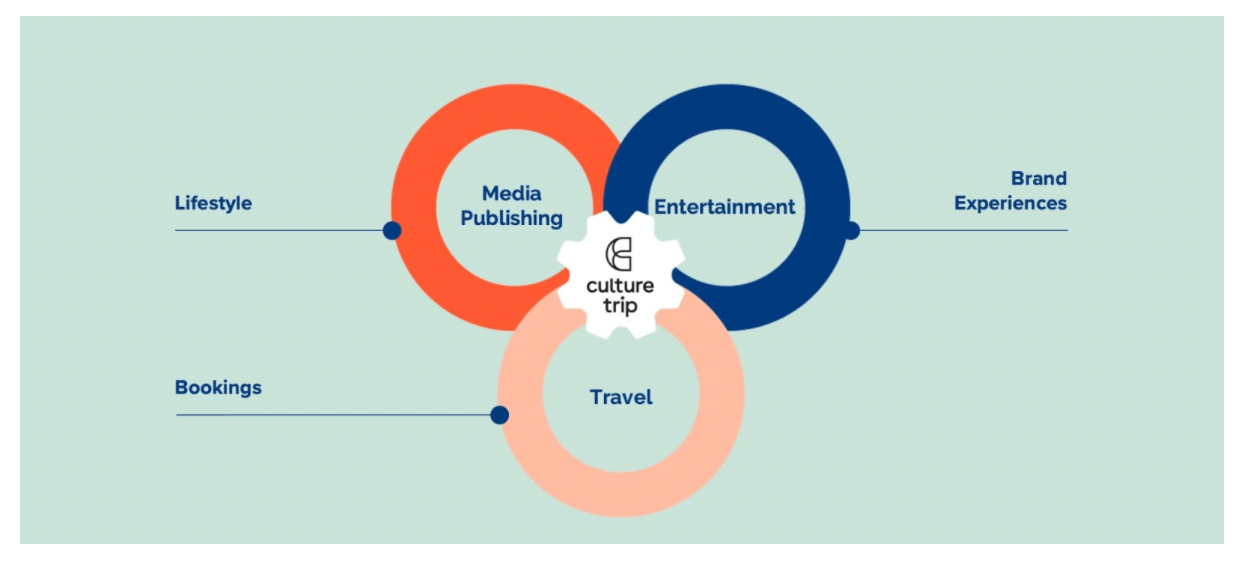

Culture Trip, is a startup operating in travel and media.

Hypergrowth

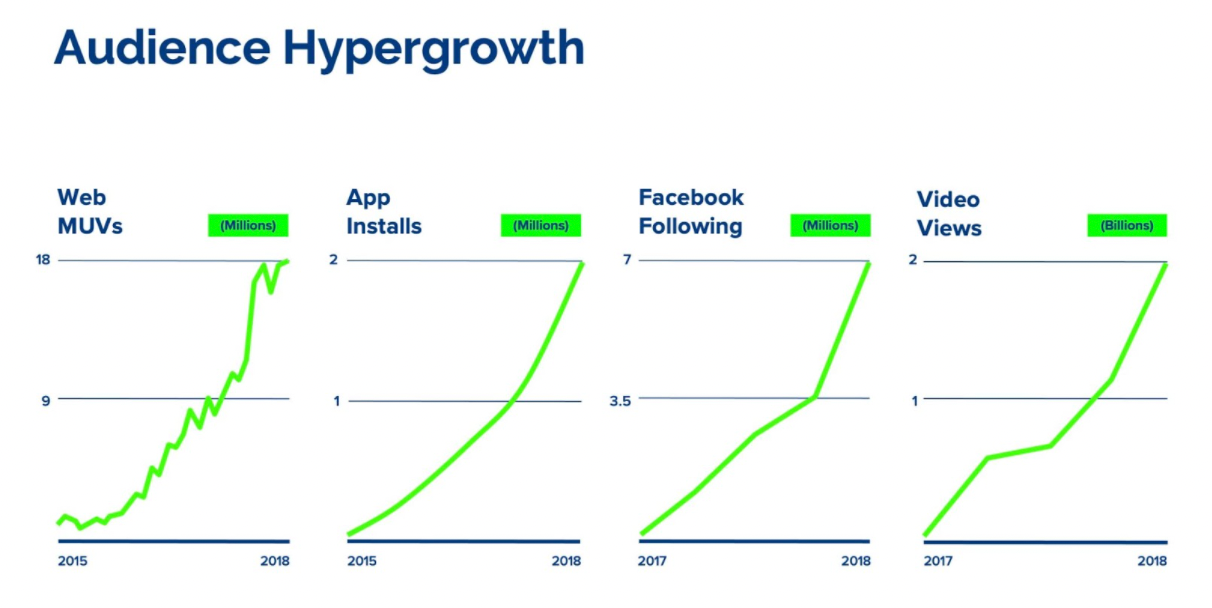

We love this graph because it shows traction and adoption.

We are in hypergrowth. These are the kinds of statistics that are incredibly joyful to see.

Defying industry categorization

But here's the thing. When you are at an intersection of essentially three categories, and you are a disrupter, you're a challenger brand.

In order for you to understand why these graphs are the way they are, you have to ask another extremely hard question, what inspires?

What inspires?

As a challenger brand, you have to ask really deep, hard questions about your audience in order to really connect with them at an emotional and ultimately practical level.

This is how this segmentation study came about.

By all accounts, it was very successful.

- We had over 50 press mentions.

- There were some amazing highlights for our founder to be invited to Sky News.

- Myself, I had a career highlight on BBC ideas to argue the case for cultural exploration.

- There was a guest blog post our founder wrote for the World Economic Forum.

All on the back of the cultural mindset segmentation study.

I will talk about this as a project to illustrate the difference between market research and data science, which is an increasingly interesting challenge product marketers need to tackle.

But first about segmentation.

Segmentation

What is segmentation?

Market segmentation is actually a research process, to essentially make something that's really fuzzy into something a lot more distinctive, concrete, targetable, valuable, and sized.

You go from a very vague understanding of your audience, as this homogenous, not quite specific target audience, into groups that you can understand, empathize with, target, and convert.

Competitors to primary market research

But here comes the first hurdle and challenge, which is you've got loads of competitors to primary market research. They're your data platforms.

Google Analytics, ComScore, Looker, SimilarWeb, Amplitude, App Annie, and many more of these kinds of platforms promise you to segment customers by their behavior.

Difference one: market (category) behavior vs. behavior in products

But here comes the first difference, segmentation is about category behavior in the market versus behavior in the product.

Google Analytics will tell you how they behave in your product, ComScore might give you a nice comparison about how you're getting to actions with audiences, SimilarWeb the same competitive analysis, but that's just behavior in-product.

They're not really telling you much about motivations and attitudes and choices people make in the category.

Buyer personas

We talk a lot today about buyer personas, which essentially is what segmentation is, they're your buyer personas, because you need to know how people buy in the category which is a fundamental outside-in approach.

Everything else is an inside-out approach from product outwards. Market segmentation is fundamentally outside-in, how people behave in the category.

The project

Here's the project. The cultural mindset study. Really Culture Trip's distinctive point of view in the travel and experiences market.

We are in a highly competitive category, a very emotional one, but very competitive. So we need to have a distinct point of view to be the challenger brand to drive disruption.

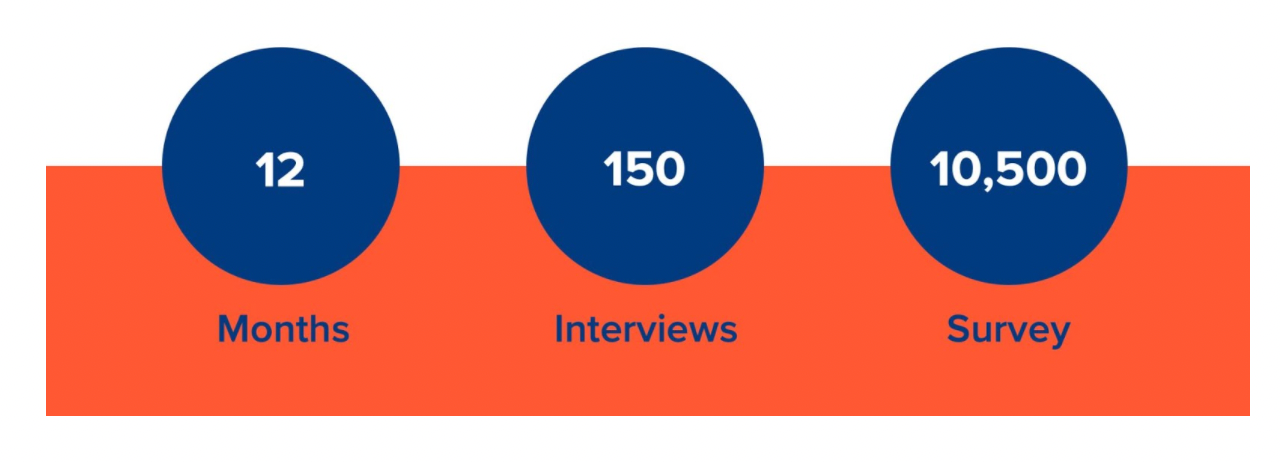

Using a mixed-method approach

We used a mixed-method approach over the course of six months.

We interviewed experts in the category.

- We did vox pops in the streets of New York and London.

- We did focus groups, very traditional discussion guides.

- We also did an online forum for a week where we asked questions ethnographically.

- Of course, this is the core of this article, we did a quant survey.

Fieldwork in numbers

Overall, the project took about 12 months, we had 150 customer interviews, one to one interviews. And the survey, in the end, was 10,500 people.

I say in the end because this was the number of people that qualified to take the survey because they were active in the category.

We were in good company for social science

When we started, we looked to social science, we looked to qualitative insights about travel and why people travel and we were in good company with very clever books.

We looked at the experience economy, third culture kids, the new demographic that grows up without borders, and we looked at the art of travel, which is why do people travel?

This brings me to a very important point about market research.

Having a point of view

By definition, compared to data science, it has a point of view. You have to inform before you even start, what it is you want to achieve in the marketplace, what kind of position you want to take as a brand, and having a point of view then becomes incredibly important.

What did we ask?

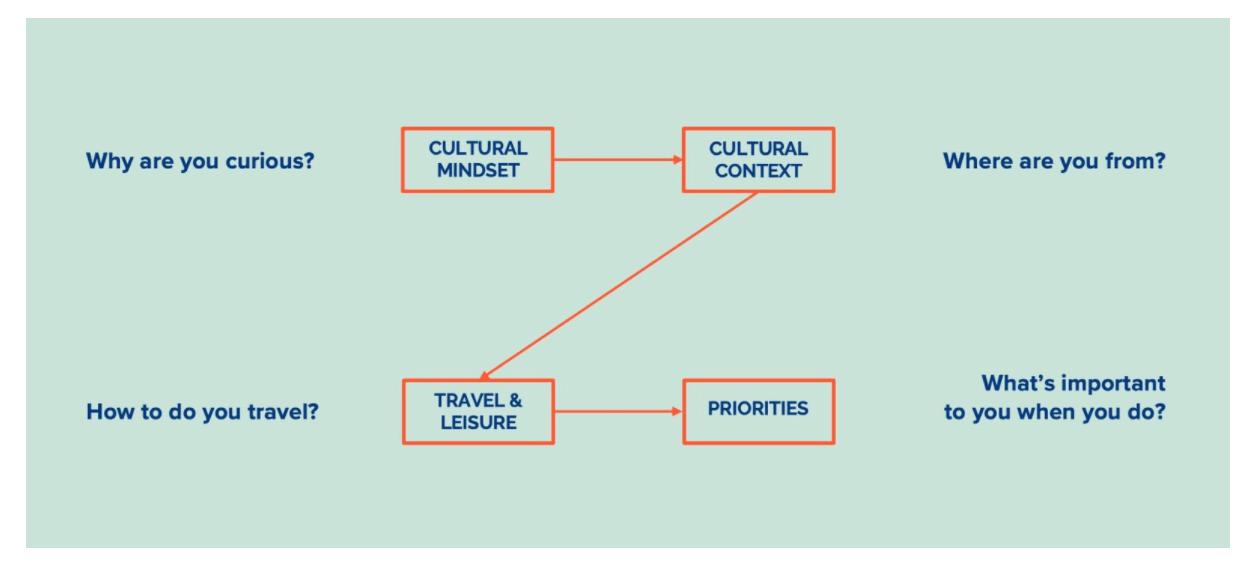

Think about it, as you look at the image, your data platforms don't really ask those kinds of questions.

- Why are you curious?

- Where are you from?

- Where's your family from? And

- How did you travel in the past?

- What's important to you when you do?

These are all very personal attitudinal questions essentially designed to find out the 'why'.

- What inspires?

- Why do you travel?

Difference two: guided conversations vs. finding patterns in raw data

That is the core, again, of what market research does compare to data science, which is guided conversations.

When you think about your Vox pops, your focus groups, even your survey, their guided conversations, they're themes you want to find out in order to establish your unique point of view.

Whereas data science fundamentally looks at raw data and starts finding patterns in it. So it doesn't really have that directional focus on trying to unearth a particular truth.

The reason why this is so important for marketers, and this is probably my most favorite quote in my market segmentation research - if you address everyone, you kind of address nobody.

The more specific you are about your target audience, your cohorts, your segments, your buyer personas, the more effective you can be at inspiring and ultimately at converting.

Here comes trouble

Nobody could have predicted this project would take as long as it did, or it would be as hard as it was but ultimately, as rewarding as it was. Because it is about Mars and Venus. Data Science meets market research.

Trouble 1:Bias

I talked about guided conversations, but data science is very anxious about bias. Words become so important and the way you phrase things become so important.

In fact, you could probably argue data science is quite anxious about words. They're very happy about data and statistics, but quite anxious about words.

Let me give you an example.

- I have trouble adapting to new cultures. Or,

- I find it easy to adapt to new cultures.

There’s a huge difference between the way you ask the question and the kind of answer you're going to get. You can actually suffer in your research from social desirability bias or confirmation bias or all sorts of bias.

It became this semantic digging at whether or not the question was valid, or the answer was valid. We had to discount I'd say about three or four questions that were potentially biassed in the system.

The first thing data science doesn't like is bias in the system, it challenges it very, very strongly. Market research is a lot lighter on that because it has to have a point of view. It has to dig into attitudes too.

Trouble 2: Tolerance

This is a principal component analysis, three lessons I never thought I'd learn, but I did.

This is the PCA that was run on the data and the 10,500 responses.

If you've ever heard of eigenvalues, you'll know it has to be more than one. If it's below one, it's no good.

At that point, after doing so much foundational work about the point of view, the survey, the qualitative analysis, we switched tack and journeyed into the world of statistical textbooks. And it's a very, very big book.

Marketing research, an applied approach - all about statistical analysis.

This is growth, personal growth, professional growth.

We interrogated the statistical model for our segmentation

We interrogated our statistical model not once, not twice, but three times.

Mars and Venus interpret 10,500 responses

Here's what happens when you interpret 10 and a half thousand responses, it's all about that idea of bias and tolerance.

Variation

Data Science wants 80% variation in data. I don't know what that means but it needs to be above 80% to be credible.

In market research, it's okay to be 60%.

Clusters

There has to be a perfect number of clusters and anybody who's worked with segmentation before knows that people don't remember very many clusters.

So we just picked six randomly, not randomly, but with a degree of sensitivity towards driving impact in the team to remember six clusters. But if the data tells you there are 12, there has to be 12.

This is what data science says, it has to be 12. But in market research, it's okay to have six and cluster them.

Difference three: Grouping people vs. personalization

This is where fundamentally, again, just from a mindset point of view the third difference is that as product marketers, we need to cluster people into groups to make our marketing activity efficient.

Whereas data science is really the driving force behind personalization. It's that understanding of precision, one-to-one targeting, behavioral data, conversions that are almost perfect.

That is what data science can help you with, something that marketing segmentation doesn't because it's inherently grouping people into bigger clusters.

Does that mean that market research quant is invalid?

Marketing, meet data science.

Life is all about probabilities. Probabilities of getting it right.

This again comes back to the 60%, the 80%, perhaps even smaller percent, it's all about the likelihood of you getting right. And ultimately, the resolution is a very, very doable one.

What customers want

What do customers want? They want to be understood and they want to be helped.

Ultimately, what that means is the marketing piece, the marketing segmentation, and the product marketing side of our business operations help consumers be understood.

You talk to them attitudinally, you talk to them emotionally, you understand the problem they're trying to solve for themselves, and you solve them.

Then the data science bit helps. It does things human curation or human marketers can't do, which is essentially serve the product at scale at a level of personalization that will be impossible to do in marketing operations.

That's how you reconcile the two functions. That's how you get them to work with each other.

Dare I say, three months on after the launch of the segmentation study, this is what we're doing. We are targeting and communicating with our customers in a way that helps them be understood.

Once they arrive at our product, and we've got them to engage and be interested and be curious in the travel proposition that we have, we help them. We help them find the right content, we match them to the experiences they're interested in. And eventually, we'll match them to the right accommodation too, now that we've launched our OTA.

This is how Mars and Venus not only research but collaborate.

Thank you.

Follow us on LinkedIn

Follow us on LinkedIn